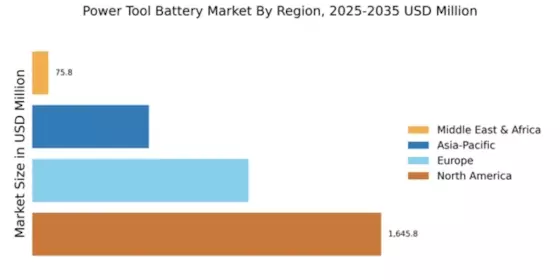

North America : Market Leader in Power Tools

North America continues to lead the power tool battery market, holding a significant share of 1645.76 million in 2024. The growth is driven by increasing demand for cordless tools in both residential and commercial sectors, alongside advancements in battery technology. Regulatory support for energy-efficient products further fuels this trend, as consumers seek sustainable options. The region's robust construction and manufacturing sectors also contribute to the rising demand for high-performance batteries. The competitive landscape in North America is characterized by the presence of major players such as DeWalt, Milwaukee, and Black & Decker. These companies are investing heavily in R&D to enhance battery performance and longevity. The U.S. market is particularly strong, with a focus on innovation and quality. As the market evolves, partnerships and collaborations among key players are expected to intensify, ensuring a dynamic and competitive environment.

Europe : Emerging Market with Growth Potential

Europe's power tool battery market is valued at 1020.0 million, reflecting a growing trend towards cordless tools and sustainable energy solutions. The region is witnessing increased investments in green technologies, driven by stringent EU regulations aimed at reducing carbon emissions. This regulatory environment is fostering innovation in battery technology, making it a key growth driver. The demand for efficient and long-lasting batteries is expected to rise as construction and DIY activities gain momentum across the continent. Leading countries in this market include Germany, France, and the UK, where companies like Bosch and Festool are prominent. The competitive landscape is marked by a mix of established brands and emerging players, all vying for market share. The focus on sustainability and energy efficiency is pushing manufacturers to innovate, ensuring that Europe remains a vital player in The Power Tool Battery. "The European market is increasingly prioritizing energy-efficient solutions to meet regulatory standards," European Commission report 2023.

Asia-Pacific : Rapid Growth in Emerging Economies

The Asia-Pacific region, valued at 550.0 million, is experiencing rapid growth in the power tool battery market, driven by urbanization and industrialization. Countries like China and India are witnessing a surge in construction activities, leading to increased demand for power tools. Additionally, the rise of e-commerce platforms is making these tools more accessible to consumers. Regulatory initiatives promoting energy efficiency are also contributing to market growth, as manufacturers adapt to meet these standards. China stands out as a leading country in this market, with significant investments in manufacturing capabilities. Key players such as Makita and Hitachi are expanding their presence in the region, focusing on innovation and product development. The competitive landscape is evolving, with both local and international brands competing for market share. As the region continues to develop, the demand for high-quality, efficient power tool batteries is expected to rise significantly.

Middle East and Africa : Untapped Market with Potential

The Middle East and Africa (MEA) power tool battery market, valued at 75.75 million, is still in its nascent stages but presents significant growth opportunities. The region is witnessing an increase in construction and infrastructure projects, driven by government initiatives aimed at economic diversification. This trend is expected to boost demand for power tools and, consequently, power tool batteries. Regulatory frameworks are gradually evolving to support sustainable practices, which will further enhance market growth. Countries like South Africa and the UAE are leading the charge in this market, with a growing number of local and international players entering the scene. The competitive landscape is characterized by a mix of established brands and new entrants, all aiming to capture market share. As the region develops, the focus on quality and efficiency in power tool batteries will become increasingly important, paving the way for future growth.