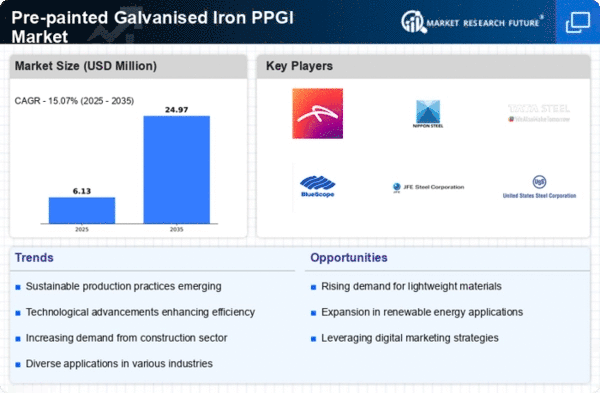

Market Share

Pre-painted Galvanised Iron PPGI Market Share Analysis

The production of pre-painted galvanized iron involves various processes designed to enhance its properties. One common method is galvanizing, wherein metal is coated with zinc by immersing it in hot molten zinc. Another technique, galvannealing, integrates the annealing and hot-dip galvanizing processes to create a specialized coating on steel. In the hot-rolled steel process, the metal is heated above its recrystallization point, typically exceeding 537.778 degrees Celsius, and then passed between two rollers to achieve specific length and thickness parameters. This heating process enhances the steel's ductility and flexibility compared to other alloys, allowing it to be shaped into a wider variety of forms. Hot-rolled steel is commonly employed in the automotive industry due to its malleability and cost-effectiveness, making it suitable for mass applications.

In the automotive sector, galvanized steel is extensively utilized for body panels and spare parts. This preference is attributed to the material's strength, ductility, durability, cost-effectiveness, and anti-corrosive qualities. The zinc coating on galvanized steel acts as a protective barrier against corrosive elements, corroding preferentially to protect the underlying steel. This sacrificial nature ensures a long-lasting and high-quality steel product. Although opting for galvanized steel may initially appear more expensive than using uncoated steel, it proves to be a wise investment in the long run due to its low maintenance costs and aesthetically pleasing appearance. Uncoated steel, lacking a protective coating, demands more maintenance to preserve both its visual appeal and structural integrity.

In the automotive sector, pre-painted galvanized iron is employed in the production of various components, including bumpers, reinforcements, door beams, seating, chassis, and frames. Additionally, the use of pre-painted galvanized iron allows for the utilization of thinner steel, contributing to additional weight savings in vehicles. Therefore, the automotive industry presents numerous opportunities for the global pre-painted galvanized iron market, given its advantageous properties and contributions to both performance and aesthetics in automobile manufacturing.

Leave a Comment