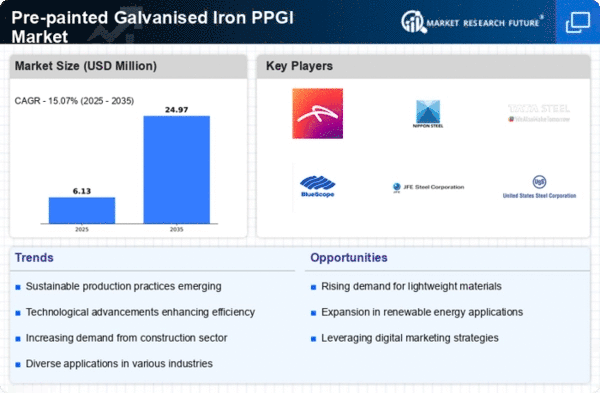

Market Trends

Key Emerging Trends in the Pre-painted Galvanised Iron PPGI Market

Pre-painted galvanized iron (PPGI) is a specialized form of galvanized iron that undergoes a process of cleaning and coating with zinc through methods like hot melt dipping or electroplating. This treated metal is transformed into various products such as coils, corrugated sheets, and galvanized strips, extensively used in the construction sector for roofing materials, wall components, and base metal products essential for industrial and commercial construction projects. PPGI is a popular choice in the construction industry, particularly in the manufacturing of roofing tiles, sheets, doors, walls, and windows, owing to its advantageous properties like corrosion resistance, durability, a broad range of colors, weather resistance, and aesthetic appeal.

In the realm of windows and doors, steel and iron, often in the form of cold-rolled PPGI, are utilized for creating grills, frames, and intricate designs. PPGI stands out as one of the most robust materials available for crafting windows and doors, possessing anti-corrosive, termite-resistant, and dustproof qualities. Its thermal resistance ensures warmth in winter while preventing excessive heat from entering during summer. The vibrant top coating adds to its visual appeal, attracting customers with varied aesthetic preferences. Moreover, PPGI boasts multiple protective layers, contributing to an extended service life, approximately four times that of regular galvanized iron sheets under similar conditions. Recognized for its ease of installation, toughness, cost-effectiveness, and sturdiness, PPGI is gaining significant recognition in the market. The escalating demand for PPGI in the construction sector acts as a driving force for the global pre-painted galvanized iron (PPGI) market.

In a recent development, ArcelorMittal Brazil initiated an expansion project at the ArcelorMittal Vega flat steel cold rolling, pickling, and galvanizing unit located in São Francisco do Sul in December 2021. This expansion encompasses the construction of a new continuous annealing line and a third galvanization line to produce cold-rolled and galvanized products. With an anticipated increase in capacity by 700,000 tonnes per year, reaching a total of 2.1 million tonnes per year, this expansion is scheduled to commence production in 2023. The augmentation of this unit not only presents numerous opportunities within the construction industry but also serves to stimulate the demand for pre-painted galvanized iron (PPGI) in the global market.

Leave a Comment