- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

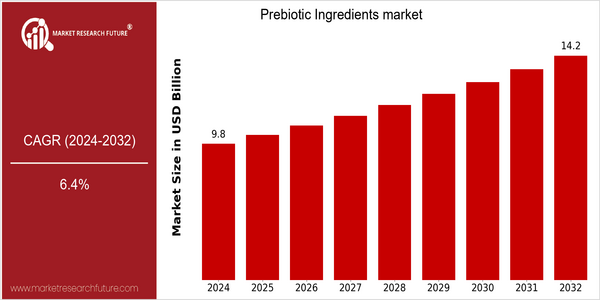

| Year | Value |

|---|---|

| 2024 | USD 9.7888 Billion |

| 2032 | USD 14.20297 Billion |

| CAGR (2024-2032) | 6.4 % |

Note – Market size depicts the revenue generated over the financial year

Prebiotics are the new wonder food, with the potential to replace fats, sugars, and salts in the diet. According to a new report, the prebiotics market is expected to grow at a CAGR of 6.4% between now and 2024. There are several reasons for this growth, the report said. Among them are the rising demand for food with added benefits, the increasing awareness of the importance of gut health, and the rising demand for dietary fiber. Prebiotics are becoming an increasingly important ingredient in food and beverage products. Also driving the market are technological advancements in food processing and extraction. The development of new prebiotics and the addition of these fibers to a wide range of products such as dairy, bakery, and dietary supplements is increasing the product portfolio. Strategic initiatives, such as forming strategic alliances and launching new products, are also being undertaken by key players in the industry. In recent times, for example, there have been several collaborations for developing new prebiotics. These collaborations reflect the industry’s focus on innovation and meeting the needs of consumers, thereby bolstering the market’s growth.

Regional Market Size

Regional Deep Dive

Prebiotics Market is growing at a high rate across the globe, mainly due to the growing awareness among the consumers about the benefits of prebiotics. The demand for food additives and dietary supplements is driving the market growth in North America, Europe, and Asia-Pacific, while the Middle East and Africa and Latin America are slowly realizing the importance of prebiotics in the field of health and well-being. Each region has its own characteristics and each of these characteristics is influenced by cultural preferences, regulatory frameworks, and economic conditions.

Europe

- The European Food Safety Authority (EFSA) has been actively evaluating health claims related to prebiotics, which has led to stricter regulations but also increased consumer trust in prebiotic products.

- Companies such as FrieslandCampina and Orafti are launching new prebiotic ingredients derived from natural sources, catering to the rising demand for clean-label products among European consumers.

Asia Pacific

- The Asia-Pacific region is witnessing a surge in health-conscious consumers, particularly in countries like Japan and Australia, where there is a growing trend towards functional foods that promote digestive health.

- Local companies, such as Yakult Honsha, are expanding their product lines to include prebiotic ingredients, leveraging traditional dietary practices to enhance product appeal and market penetration.

Latin America

- The Latin American market is beginning to embrace prebiotic ingredients, driven by rising health awareness and the popularity of natural and organic products among consumers.

- Organizations such as the Brazilian Association of Food Science and Technology (ABCT) are promoting research and development in prebiotic applications, which is expected to enhance product innovation in the region.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated its guidelines on dietary fibers, which include prebiotics, leading to increased clarity and confidence among manufacturers and consumers regarding product labeling and health claims.

- Key players like DuPont and Bifidobacterium are investing in R&D to develop innovative prebiotic formulations, particularly targeting the growing vegan and plant-based food segments, which are gaining traction in North America.

Middle East And Africa

- In the Middle East, there is a growing interest in health and wellness, with local governments promoting dietary changes that include the incorporation of prebiotic ingredients into traditional foods.

- Companies like Almarai are exploring the integration of prebiotics into dairy products, aiming to cater to the increasing demand for functional foods in the region.

Did You Know?

“Approximately 70% of the immune system is located in the gut, making prebiotics essential for maintaining overall health and wellness.” — National Institutes of Health (NIH)

Segmental Market Size

Prebiotics are a crucial part of the overall health and well-being market, which is currently experiencing robust growth, mainly driven by the growing interest in gut health. The increasing demand for natural and functional foods, as well as the growing scientific evidence, are the main drivers of the prebiotics market. In addition, the regulatory support for health claims on prebiotics has bolstered the market’s appeal, especially in North America and Europe. In the present-day prebiotics market, the use of prebiotics as ingredients is largely mature, with companies like Bifodan and DuPont leading the way in terms of product innovation and market penetration. The most important applications are in dietary supplements, beverages and food, such as in yogurt with added dietary fiber and in digestive health supplements. The rising interest in immune health, as well as the growing focus on sustainable production, are driving the market. Fermentation and enzymatic processes are the mainstays of the market’s evolution, enabling the development of more diverse and effective prebiotic formulations.

Future Outlook

Prebiotic ingredients are expected to grow significantly from 2024 to 2032. The market is expected to increase from approximately US$9.79 billion to approximately US$14.20 billion, at a robust CAGR of 6.4%. The main reasons for this growth are the growing awareness of the importance of the intestinal flora, the growing demand for food supplements and the increasing trend towards dietary and nutritional foods. In view of the increasing trend of natural products to enhance well-being, the penetration of prebiotics in food and beverages is expected to increase, reaching more than 30% in certain markets by 2032. In addition, the technological development of extraction and formulation methods will lead to a more effective and varied product portfolio. Moreover, a favorable regulatory framework and increasing R&D expenditure will also lead to further growth. The integration of prebiotics into individualized nutrition and the growing acceptance of plant-based diets will also have an impact on consumers’ preferences, which will then result in a wider acceptance and use of prebiotics in various sectors. However, to make the most of this development, the market requires a flexible and dynamic structure.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 9.2 Billion |

| Market Size Value In 2023 | USD 9.7888 Billion |

| Growth Rate | 6.40% (2023-2030) |

Prebiotic Ingredients Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.