Major market players are spending a lot on R&D to increase their product lines, which will help the Prebiotic Ingredients market grow even more. Market participants are also taking various strategic initiatives to grow their worldwide footprint, with key market developments such as new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Competitors in the Prebiotic Ingredients industry must offer cost-effective items to expand and survive in an increasingly competitive and rising market environment.

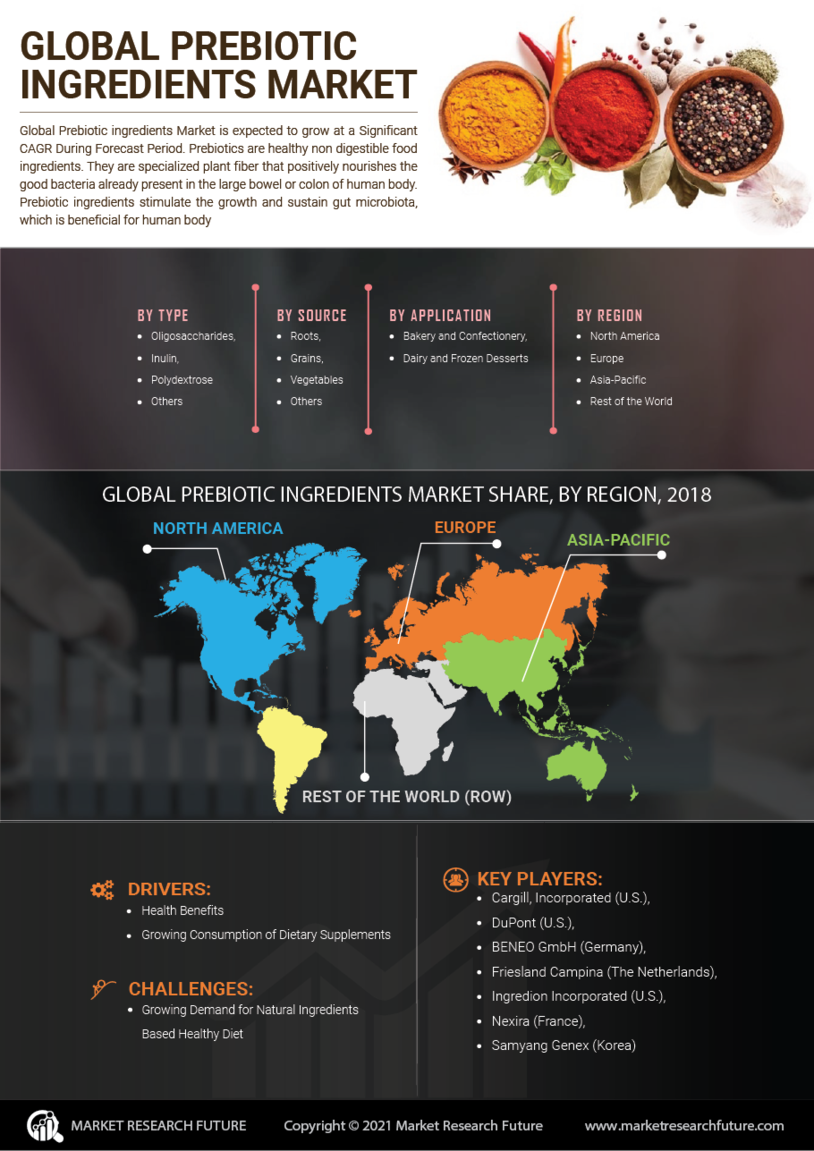

Manufacturing locally to reduce operating costs is one of the primary business strategies manufacturers adopt in the Prebiotic Ingredients industry to benefit clients and expand the market sector. In recent years, the Prebiotic Ingredients industry has provided medicine with some of the most significant benefits. The Prebiotic Ingredients markets major players such as Cargill Incorporated (U.S.), Friesland Campina (The Netherlands), Samyang Genex (Korea), Nexira (France), DuPont (U.S.), Ingredion Incorporated (U.S.), BENEO GmbH (Germany), and others are working on expanding the market demand by investing in research and development activities.

DuPont (US) Often abbreviated as DuPont, the French-American industrialist and chemist Éleuthère Irénée du Pont de Nemours founded the multinational chemical company in 1802. The business began as a significant supplier of gunpowder and later played a significant role in the growth of Delaware. In the 20th century, DuPont produced a variety of polymers, including Vespel, neoprene, nylon, Corian, Teflon, Mylar, Kapton, Kevlar, Zemdrain, M5 fiber, Nomex, Tyvek, Sorona, Corfam, and Lycra. Its scientists also produced a variety of chemicals, most notably Freon (chlorofluorocarbons), for the refrigerant. Additionally, it produced synthetic paints and pigments like ChromaFlair.

Also, Cargill Incorporated (US), to nourish the world safely, ethically, and sustainably, Cargill's 155,000 employees across 70 countries work tirelessly every day. We link customers with ingredients, farmers with markets, and people and animals with the food they require to survive every day. We serve as a trusted partner for customers in the food, agriculture, financial, and industrial sectors in more than 125 countries by fusing our 155 years of experience with new technologies and insights. We are constructing an agricultural future that is more robust and sustainable together.

Tereos Group introduced FOSbeauty as a new prebiotic ingredient specifically designed for skin microbiota.

Royal DSM has announced that two of its probiotic strains have been granted New Dietary Ingredient (NDI) status by the US Food and Drug Administration (FDA) in February 2022. This makes DSM’s partners happy. Lactobacillus rhamnosus 19070-2 and Lactobacillus reuteri 12246-CU of this Dutch health giant show continued investment on gut health solutions.

Archer Daniels Midland Company – a global leader in nutrition and agricultural origination and processing – announced an important addition to its extensive range of products for health and wellness with the purchase of Deerland Probiotics, Prebiotics, and Enzymes based in the US during November 2021.

DuPont Nutrition & Biosciences said it will expand production capacity for its prebiotic fiber Litesse® Ultra™ because demand is growing June this year.

For example, MOJU – United Kingdom's functional food & drink company – launched a prebiotic shot in March this year with a blend of prebiotics and plant fibers such as green banana, golden kiwi, baobab and chicory root inulin.

Both Taiyo GmBH, a Germany-based brand of naturally sourced dietary fibers and Asiros, a Danish fruit powder manufacturer, combined their resources to create high-fiber fruit varieties in 2021.

For example, BENEO announced that it is investing over EUR 50 million in expanding its chicory root manufacturing facility in Chile by 2022 in March last year.