Market Trends

Key Emerging Trends in the Predictive Disease Analytics Market

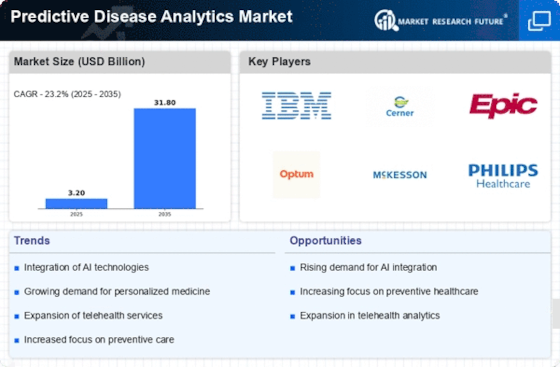

Technological advancements, increased importance of preventative care and the need for more data-oriented approach in healthcare results to a major transformation taking place within predictive disease analytics market. One of the trends is to use predictive analytics tools for forecasting and controlling diseases. Various advanced algorithms and machine learning models are used by healthcare providers as well organizations to analyze large datasets, detect patterns and predict disease trajectories. Such a transition to predictive analytics, therefore, represents an active paradigm of health care noting the early intervention and personalized treatment approaches plus efficient use of resources etc. The predictive disease analytics market is highly influenced by the integration of AI and ML. Such innovations endow the analytics platforms with processing and interpreting of sophisticated healthcare data for more accurate predictions. AI and ML algorithms can detect even small patterns of patient data, thereby increasing accuracy in disease predictions that aid better healthcare decision-making. This trend reflects a shift towards smarter, data-driven, and patient centric interventions. Thus, remote monitoring is emerging as an important aspect of predictive disease analytics. There is an increase in the use of wearable devices, connected healthcare applications and mobile health which enables real-time data collection. This remote monitoring enables health care providers to monitor patient’s vital signs all the time, anticipate problems and act preventively. Incorporating remote patient monitoring into predictive analytics coincides with the overall movement towards value-based care and person-centered healthcare delivery. One of the major trends in predictive disease analytics market is personalised medicine. With the help of predictive analytics, healthcare providers can use patients’ personal data such as genetic components or lifestyle factors to adopt individualized treatment approaches. This individualized method increases the effectiveness of interventions, reduces side effects, and improves patient outcomes. The growing emphasis on personalized medicine emphasizes the fact that patients should be treated as individuals with specific needs for health care. The predictive disease analytics market focuses on early detection and prevention. Identifying potential health risks and diseases in their early stages enables timely interventions that include preventative actions. Predictive analytics allows healthcare professionals to identify high-risk populations, implement preventative measures designed specifically for them, and decrease the total load on health systems in general. This pattern corresponds with the transition to a more targeted and preventative approach in terms of healthcare.

Leave a Comment