Increased Focus on Customer Experience

Enhancing customer experience has emerged as a pivotal driver for the Prescriptive Analytics Market. Organizations are increasingly recognizing that personalized and timely interactions can significantly impact customer satisfaction and loyalty. Prescriptive analytics enables businesses to analyze customer behavior and preferences, allowing them to tailor their offerings accordingly. This capability is particularly valuable in sectors such as retail and finance, where understanding customer needs is essential for success. As companies strive to create more engaging and relevant experiences for their customers, the demand for prescriptive analytics solutions is likely to grow. This trend suggests that the Prescriptive Analytics Market will continue to expand, as organizations invest in technologies that facilitate deeper insights into customer behavior and preferences.

Growing Need for Operational Efficiency

The pursuit of operational efficiency is a significant driver for the Prescriptive Analytics Market. Organizations across various sectors are under constant pressure to optimize their processes, reduce costs, and improve overall performance. Prescriptive analytics provides the tools necessary to identify inefficiencies and recommend actionable strategies for improvement. For instance, industries such as manufacturing and logistics are increasingly utilizing prescriptive analytics to streamline operations and enhance supply chain management. As a result, the market for prescriptive analytics is expected to witness substantial growth, as businesses seek to implement data-driven solutions that can lead to measurable improvements in efficiency. This trend indicates a strong alignment between operational goals and the capabilities offered by prescriptive analytics, further solidifying its role in the market.

Regulatory Compliance and Risk Management

Regulatory compliance and risk management are increasingly influencing the Prescriptive Analytics Market. Organizations are faced with a myriad of regulations that require them to maintain compliance while managing risks effectively. Prescriptive analytics can assist in identifying potential compliance issues and recommending strategies to mitigate risks. This capability is particularly relevant in industries such as finance and healthcare, where regulatory requirements are stringent. As businesses seek to navigate complex regulatory landscapes, the demand for prescriptive analytics solutions that can provide insights into compliance and risk management is expected to rise. This trend indicates that the Prescriptive Analytics Market will play a crucial role in helping organizations meet their regulatory obligations while minimizing potential risks.

Advancements in Technology and Infrastructure

Technological advancements play a crucial role in shaping the Prescriptive Analytics Market. The proliferation of cloud computing, artificial intelligence, and machine learning technologies has enabled organizations to process vast amounts of data more efficiently. These innovations facilitate the development of sophisticated prescriptive analytics tools that can analyze complex datasets and generate actionable recommendations. As organizations increasingly adopt these technologies, the market for prescriptive analytics is anticipated to expand. Furthermore, the integration of advanced analytics into existing IT infrastructures is becoming more seamless, allowing businesses to leverage their data assets effectively. This trend suggests that the Prescriptive Analytics Market will continue to evolve, driven by ongoing technological improvements that enhance the capabilities of analytics solutions.

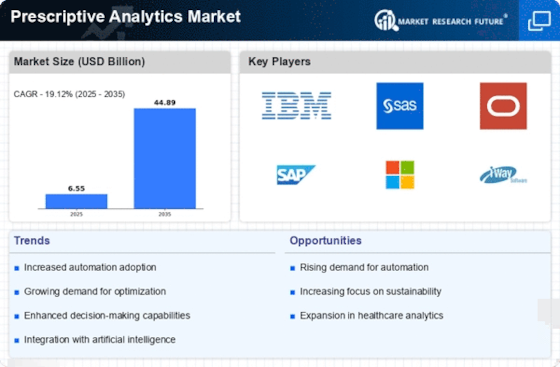

Rising Demand for Data-Driven Decision Making

The increasing emphasis on data-driven decision making is a primary driver for the Prescriptive Analytics Market. Organizations are recognizing the value of leveraging data to inform strategic choices, optimize operations, and enhance customer experiences. According to recent estimates, the market for prescriptive analytics is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This growth is fueled by the need for businesses to remain competitive in an increasingly complex environment. As companies seek to harness the power of big data, the demand for prescriptive analytics solutions that can provide actionable insights is likely to rise significantly. Consequently, this trend is expected to propel the Prescriptive Analytics Market forward, as organizations invest in advanced analytics tools to drive efficiency and innovation.