Focus on Energy Efficiency

The growing emphasis on energy efficiency is a crucial driver of the Process Instrumentation Equipment Market. As organizations seek to reduce operational costs and minimize their environmental impact, the demand for energy-efficient instrumentation solutions is on the rise. This trend is particularly evident in industries such as manufacturing and utilities, where energy consumption constitutes a significant portion of operational expenses. The implementation of advanced process instrumentation can lead to optimized energy usage, thereby enhancing overall efficiency. Furthermore, regulatory incentives aimed at promoting energy efficiency are likely to bolster the growth of the Process Instrumentation Equipment Market, as companies invest in technologies that align with sustainability goals.

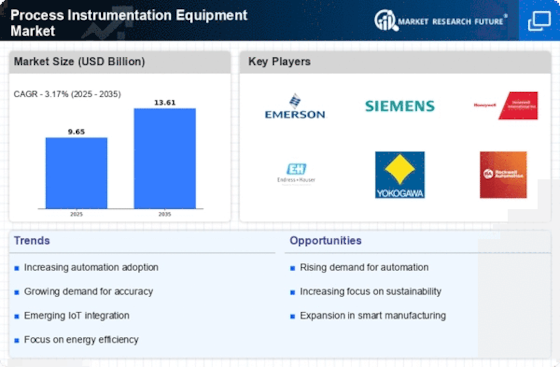

Rising Demand for Automation

The increasing demand for automation across various industries is a primary driver of the Process Instrumentation Equipment Market. As companies strive to enhance operational efficiency and reduce human error, the adoption of automated systems becomes essential. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 9% over the next few years. This trend is particularly evident in sectors such as manufacturing, oil and gas, and pharmaceuticals, where precision and reliability are paramount. The Process Instrumentation Equipment Market is likely to benefit from this shift, as advanced instrumentation solutions are integral to the automation process, enabling real-time monitoring and control of industrial operations.

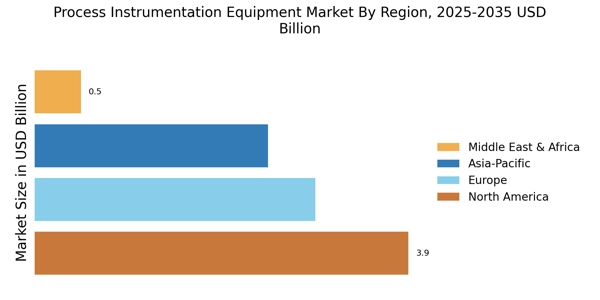

Growth in End-User Industries

The growth of end-user industries such as oil and gas, water and wastewater, and food and beverage is a significant driver of the Process Instrumentation Equipment Market. As these sectors expand, the demand for reliable and accurate instrumentation solutions increases. For instance, the oil and gas industry is expected to witness substantial investments in process instrumentation to enhance exploration and production efficiency. Similarly, the water and wastewater sector is focusing on upgrading its infrastructure, which necessitates advanced instrumentation for monitoring and control. This growth in end-user industries is likely to create numerous opportunities for the Process Instrumentation Equipment Market, as companies seek to implement state-of-the-art solutions to meet their operational needs.

Regulatory Compliance and Safety Standards

Stringent regulatory compliance and safety standards are increasingly influencing the Process Instrumentation Equipment Market. Industries such as food and beverage, pharmaceuticals, and chemicals are subject to rigorous regulations that mandate the use of precise instrumentation for monitoring and controlling processes. The need to adhere to these regulations drives the demand for advanced process instrumentation solutions. For instance, the implementation of the ISO 9001 quality management system has led to a heightened focus on quality control and assurance. As a result, companies are investing in sophisticated instrumentation to ensure compliance, thereby propelling the growth of the Process Instrumentation Equipment Market. This trend is expected to continue as regulatory bodies evolve and impose stricter guidelines.

Technological Advancements in Instrumentation

Technological advancements in instrumentation are significantly shaping the Process Instrumentation Equipment Market. Innovations such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning are revolutionizing how process instrumentation is utilized. These technologies enable enhanced data collection, analysis, and predictive maintenance, which can lead to improved operational efficiency. For example, the integration of IoT in instrumentation allows for remote monitoring and control, reducing downtime and maintenance costs. The Process Instrumentation Equipment Market is poised for growth as companies increasingly adopt these advanced technologies to optimize their processes and gain a competitive edge.