Market Analysis

In-depth Analysis of Process Spectroscopy Market Industry Landscape

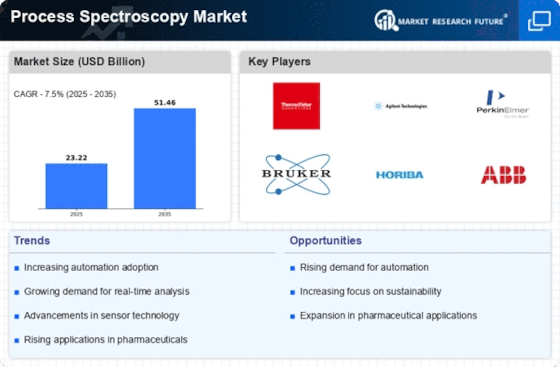

The Process Spectroscopy Market is characterized by dynamic and evolving market dynamics that influence its growth and trends. One of the key driving forces is the increasing emphasis on quality control and process optimization across industries. As manufacturing processes become more complex, the demand for real-time monitoring and analysis of materials rises, propelling the adoption of process spectroscopy technologies. Industries such as pharmaceuticals, food and beverages, and chemicals seek to enhance product quality and operational efficiency, driving the market forward.

Technological advancements play a pivotal role in shaping the market dynamics of process spectroscopy. Continuous innovation in spectroscopy hardware, software, and analytical techniques results in improved accuracy, reliability, and versatility of spectroscopy solutions. The integration of artificial intelligence and machine learning further amplifies the capabilities of these systems, enabling predictive analytics and proactive process adjustments. This relentless pursuit of technological excellence not only meets the current industry demands but also expands the scope of applications, fostering market growth.

Regulatory landscape dynamics significantly impact the Process Spectroscopy Market. Stringent regulations and standards in industries such as pharmaceuticals and food processing propel the adoption of spectroscopy solutions for compliance and quality assurance. As regulatory bodies worldwide tighten their scrutiny on manufacturing processes, companies are increasingly investing in process spectroscopy technologies to ensure adherence to standards. The ability of spectroscopy solutions to provide accurate and traceable data aligns well with regulatory requirements, making them indispensable for compliance.

Economic factors also contribute to the market dynamics of process spectroscopy. Economic stability and growth stimulate investments in industrial processes, prompting companies to adopt advanced technologies like process spectroscopy for efficiency gains. Conversely, economic downturns may lead to budget constraints and a cautious approach toward technology investments. Understanding these economic fluctuations is essential for market players to tailor their strategies according to prevailing economic conditions.

The global nature of the Process Spectroscopy Market introduces geographical dynamics that impact its trajectory. Regions with established industrial bases and a culture of technological innovation, such as North America and Europe, often witness early adoption of process spectroscopy solutions. However, the market dynamics are shifting, with emerging economies in Asia-Pacific and Latin America gaining prominence. Rapid industrialization in these regions, coupled with a growing awareness of the benefits of process spectroscopy, presents significant growth opportunities.

Competitive dynamics form a critical aspect of the Process Spectroscopy Market. The presence of numerous players, ranging from established companies to startups, fosters a competitive landscape. Market players engage in continuous innovation, strategic partnerships, and mergers and acquisitions to strengthen their market position. This competitive environment not only spurs technological advancements but also provides customers with a diverse range of options, fostering healthy market dynamics.

Furthermore, environmental and sustainability considerations are increasingly influencing market dynamics. Process spectroscopy aids in optimizing resource utilization, reducing waste, and minimizing environmental impact. As industries face growing pressure to adopt sustainable practices, the demand for process spectroscopy solutions that contribute to environmental goals is on the rise, influencing market dynamics in favor of eco-friendly technologies.

Leave a Comment