Protective Fabrics Size

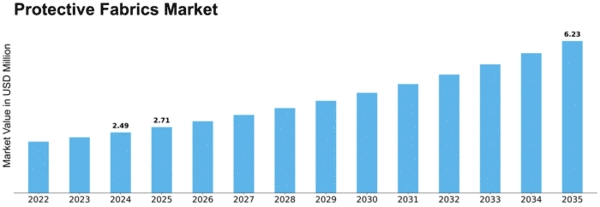

Protective Fabrics Market Growth Projections and Opportunities

The market for protective fabrics is influenced by a variety of factors that shape supply, demand, and pricing dynamics. One key factor is technological advancements in fabric manufacturing. As new materials and production techniques emerge, protective fabrics become more efficient, durable, and versatile. This drives innovation in the industry and encourages manufacturers to develop products that meet evolving safety standards and consumer preferences.

Protective fabrics are a collection of performance fabrics that are used in the production of a variety of protective clothing for people working in a hazardous environment. These clothes are worn to prevent the person from coming in direct contact with the adverse effects of thermal, mechanical, chemical, and other hazards.

Another important market factor is government regulations and industry standards. Regulatory requirements play a significant role in shaping the demand for protective fabrics, particularly in industries such as construction, healthcare, and firefighting. Compliance with safety regulations often necessitates the use of specialized protective clothing and gear, creating a steady demand for high-quality fabrics.

The overall economic environment also influences the protective fabrics market. Economic conditions, such as GDP growth, inflation rates, and employment levels, can impact consumer purchasing power and business investment decisions. During periods of economic expansion, industries may invest more in worker safety and protective equipment, leading to increased demand for protective fabrics. Conversely, economic downturns may result in reduced spending on safety gear, affecting market growth.

Globalization is another factor that affects the protective fabrics market. The expansion of international trade and the interconnectedness of economies create both opportunities and challenges for manufacturers. On one hand, globalization allows companies to access new markets and source materials more efficiently. On the other hand, increased competition from foreign manufacturers can put pressure on prices and profit margins.

Environmental concerns and sustainability are becoming increasingly important considerations in the protective fabrics market. As awareness of environmental issues grows, consumers and businesses are seeking out eco-friendly and sustainable products. This has led to the development of protective fabrics made from recycled materials or produced using environmentally friendly processes. Companies that prioritize sustainability may gain a competitive advantage and appeal to environmentally conscious customers.

Consumer preferences and lifestyle trends also influence the demand for protective fabrics. In addition to meeting safety requirements, consumers often seek out clothing and gear that offer comfort, style, and performance. This has led to the development of protective fabrics that are lightweight, breathable, and aesthetically pleasing. Manufacturers must stay attuned to changing consumer preferences and market trends to remain competitive in the industry.

Furthermore, advancements in healthcare technology and an aging population are driving demand for protective fabrics in the medical sector. With an increasing focus on infection control and patient safety, healthcare facilities are investing in protective clothing and textiles to minimize the risk of contamination and transmission of pathogens. This has created opportunities for manufacturers to develop specialized fabrics for medical applications, such as surgical gowns, face masks, and protective drapes.

Overall, the protective fabrics market is influenced by a complex interplay of factors, including technological innovation, regulatory requirements, economic conditions, globalization, environmental considerations, consumer preferences, and healthcare trends. Manufacturers must carefully navigate these market dynamics to meet the evolving needs of customers and remain competitive in the industry.

Leave a Comment