Market Share

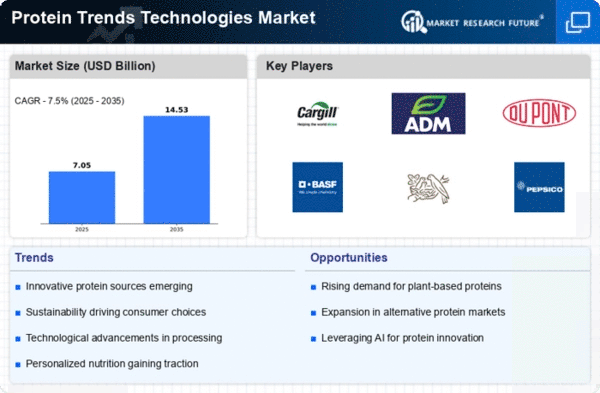

Protein Trends Technologies Market Share Analysis

Companies use numerous tactics to position themselves strategically and acquire market share in the ever-changing Protein Trends and Technologies Market. Product innovation and differentiation are key strategies. To meet changing consumer tastes, companies invest heavily in protein product R&D. Plant-based proteins, alternative protein sources, and protein fortification in food and beverages are examples. Companies want to stand out to health-conscious consumers looking for diversified and sustainable protein sources by staying ahead of protein trends.

Protein Trends and Technologies Market dynamics depend on pricing tactics. Protein product prices depend on production costs, sourcing techniques, and nutritional content. In the extremely competitive protein supplement business, companies may use competitive pricing to attract a wide audience. Specialized or high-quality protein products with distinct nutritional profiles or dietary requirements may be priced premium. Maintaining competition and ensuring consumers notice protein products' nutritional benefits requires balancing pricing and perceived value.

Brand positioning also affects Protein Trends and Technologies Market share. Companies emphasise product quality, sustainability, and customer values to establish powerful brands. Effective marketing efforts, ethical and environmental certifications, and influencer or health expert collaborations boost brand recognition. A positive brand image attracts protein consumers who value transparency and ethical sourcing and builds customer loyalty.

Protein product accessibility depends on distribution networks. Companies strategically partner with retailers, e-commerce platforms, and health and wellness stores to maximize product availability. Protein goods reach a large customer base thanks to an effective distribution network that accounts for market preferences and dietary demands. Collaborations with foodservice providers and restaurants help protein products go beyond retail channels.

Protein Trends and Technologies Market strategies include working with nutritionists, fitness professionals, and health influencers. Companies promote their protein products' nutritional benefits and uses through partnerships, sponsorships, and education. Companies hope to increase consumer confidence and influence purchases by partnering with respectable health and wellness voices. These agreements also spread correct protein trends and technology information, boosting the company's and goods' image.

Protein Trends and Technologies Market regulations and quality requirements are non-negotiable. Given the importance of product safety and proper labeling in the food and beverage business, companies that prioritize rigorous testing, quality assurance, and regulatory compliance establish consumer trust. Transparent communication about sourcing, production, and international food safety regulations makes a Protein Trends and Technologies Market player responsible and trusted."

Leave a Comment