Market Trends

Key Emerging Trends in the Protein Trends Technologies Market

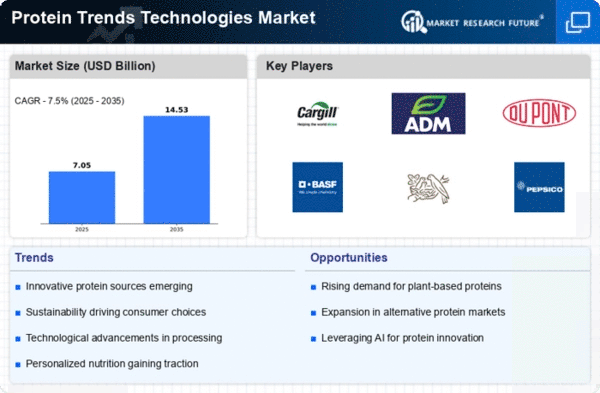

The Protein Trends and Technologies market is changing due to customer tastes, technology, and a focus on sustainable and plant-based protein sources. Market trends include rising demand for plant-based proteins. With the rise of vegetarianism, veganism, and plant-centric diets, animal-based protein sources are declining. This trend is pushing plant protein technology innovation, resulting in a variety of plant-derived protein products to fulfill consumer nutritional needs.

To address sustainability, protein technologies are advanced. Traditional animal agriculture's environmental effect has spurred the search for sustainable protein sources. This has led to cell-based and fermentation-derived protein technologies. These technologies support the global quest for sustainable and ethical food choices by producing protein more sustainably and efficiently.

To address demand for protein-enriched foods and beverages, several food and beverage items are adding protein. Protein is being added to snacks, beverages, meal replacements, and sports nutrition products to suit different tastes and lifestyles. The increased awareness of protein's role in health, muscle maintenance, and satiety drives this trend.

Personalized nutrition and protein product customisation to fit health goals and dietary needs are also rising. Technology and genetic testing allow companies to offer individualized protein solutions depending on an individual's genetics, health, and lifestyle. This trend shows a protein market movement toward customization and consumer focus.

Protein product clean label and transparent sourcing are also growing. Protein with few ingredients, no chemicals, preservatives, or allergens is what consumers want. This clean label movement is affecting product development and marketing as producers address demand for natural and minimally processed protein sources.

Novel protein sources outside plant and animal origins also affect the Protein Trends and Technologies market. Alternative protein sources including insects, algae, and fungi may be healthier and better for the environment. Diversifying protein sources makes the protein industry more flexible and adaptable, giving customers more options and encouraging protein technology innovation.

The market is also responding to growing awareness of proteins' involvement in worldwide hunger. Protein fortification and supplementation are becoming significant ways to fight protein deficit, especially in locations with inadequate protein sources. This trend emphasizes protein technology' role in global food security and nutrition.

Leave a Comment