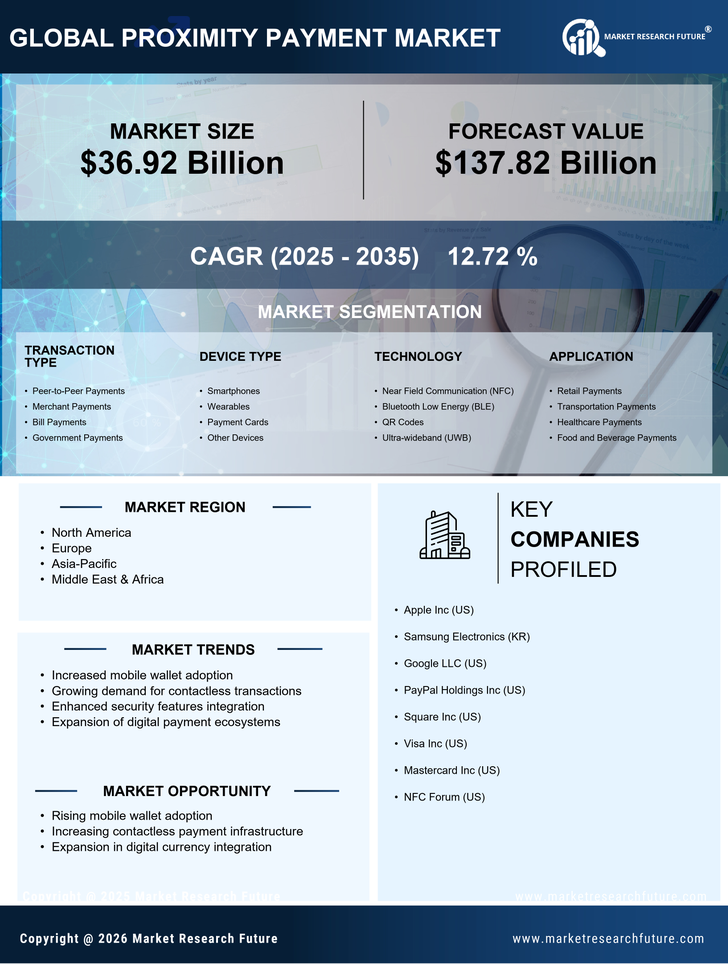

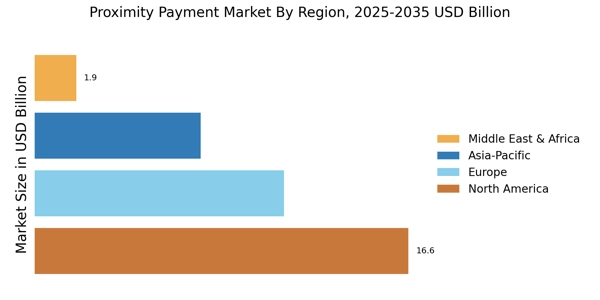

North America : Digital Payment Leader

North America is the largest market for proximity payments, holding approximately 45% of the global share. The region's growth is driven by high smartphone penetration, increasing consumer preference for contactless payments, and supportive regulatory frameworks. The U.S. leads the market, followed by Canada, which is rapidly adopting digital payment solutions. Regulatory initiatives, such as the Consumer Financial Protection Bureau's guidelines, further enhance market growth. The competitive landscape in North America is robust, featuring key players like Apple Inc, Google LLC, and PayPal Holdings. These companies are continuously innovating to enhance user experience and security in proximity payments. The presence of major financial institutions and technology firms fosters a dynamic ecosystem, making it easier for consumers to adopt contactless payment methods. The region's focus on cybersecurity and consumer protection also plays a crucial role in maintaining trust in digital transactions.

Europe : Emerging Payment Innovations

Europe is witnessing significant growth in the proximity payment market, accounting for approximately 30% of the global share. The region's expansion is fueled by increasing consumer demand for seamless payment experiences and the European Union's regulatory support for digital transactions. Countries like the UK and Germany are at the forefront, with extensive infrastructure for contactless payments, driven by initiatives such as the European Payment Services Directive (PSD2). Leading countries in Europe include the UK, Germany, and France, where major players like Visa Inc and Mastercard Inc are actively enhancing their offerings. The competitive landscape is characterized by a mix of traditional banks and fintech companies, fostering innovation in payment solutions. The presence of regulatory bodies ensures a secure environment for consumers, promoting the adoption of proximity payments across various sectors, including retail and transportation.

Asia-Pacific : Rapid Adoption of Technology

Asia-Pacific is emerging as a powerhouse in the proximity payment market, holding around 20% of the global share. The region's growth is driven by rapid urbanization, increasing smartphone usage, and a young, tech-savvy population. Countries like China and India are leading the charge, with significant investments in digital payment infrastructure and favorable government policies promoting cashless transactions. The rise of e-commerce further accelerates the demand for contactless payment solutions. China is the largest market in the region, with companies like Alibaba and Tencent dominating the landscape. India follows closely, with a growing number of startups and established players like Paytm and PhonePe innovating in the payment space. The competitive environment is vibrant, with a mix of local and international players striving to capture market share. Regulatory support from governments enhances consumer confidence, driving the adoption of proximity payments across various sectors, including retail and transportation.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa region is gradually emerging in the proximity payment market, currently holding about 5% of the global share. The growth is primarily driven by increasing smartphone penetration, urbanization, and a shift towards cashless economies. Countries like the UAE and South Africa are leading the way, with government initiatives aimed at promoting digital payments and enhancing financial inclusion. The region's diverse population presents unique opportunities for tailored payment solutions. In the competitive landscape, local players are collaborating with global technology firms to enhance their offerings. The presence of key players like Mastercard and Visa is notable, as they work to establish a robust payment infrastructure. Regulatory bodies are increasingly focusing on creating a secure environment for digital transactions, which is essential for building consumer trust and encouraging the adoption of proximity payments across various sectors, including retail and hospitality.