-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Market Structure

-

Market Research Methodology

-

Research Process

-

Secondary Research

-

Primary Research

-

Forecast Model

-

Market Landscape

-

Five Forces Analysis

- Threat of New Entrants

- Bargaining power of Buyers

- Bargaining power of Suppliers

- Threat of Substitutes

- Segment Rivalry

-

Value Chain/Supply Chain of Global Pulp & Paper Chemicals Market

-

Industry Overview of Global Pulp & Paper Chemicals Market

-

Introduction

-

Growth Drivers

-

Impact Analysis

-

Market Challenges

-

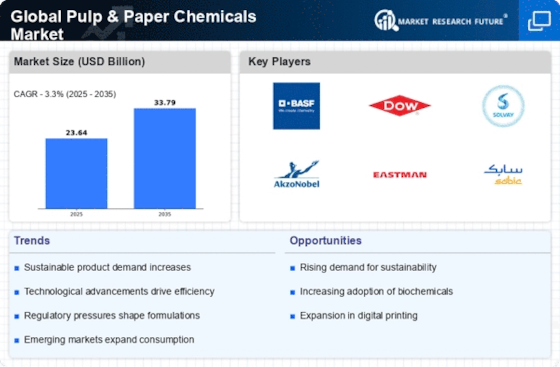

Market Trends

-

Introduction

-

Growth Trends

-

Impact Analysis

-

Global Pulp & Pulp & Paper Chemicals Market, by Type

-

Introduction

-

Pulping Chemicals

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Bleaching & Deinking Chemicals

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Fillers & Coatings

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Specialty Additives

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Polymers

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Others

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Global Pulp & Pulp & Paper Chemicals Market, by Application

-

Introduction

-

Pulp

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Paperboard & Tissue

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Printing & Writing

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

General Purpose

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Global Pulp & Pulp & Paper Chemicals Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Type, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Application, 2023–2030

- US

- Canada

-

Europe

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Type, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Application, 2023–2030

- Germany

- France

- Italy

- Spain

- UK

- Russia

- Poland

-

Asia-Pacific

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Type, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Application, 2023–2030

- China

- India

- Japan

- Australia

- New Zealand

- Rest of Asia-Pacific

-

Middle East & Africa

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Type, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Application, 2023–2030

- Turkey

- Israel

- North Africa

- GCC

- Rest of the Middle East & Africa

-

Latin America

- Market Estimates & Forecast, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Type, 2023–2030

- Market Estimates & Pulp & Paper Chemicals Market, by Application, 2023–2030

- Brazil

- Argentina

- Mexico

- Rest of Latin America

-

Company Landscape

-

Company Profiles

-

BASF SE

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Kemira

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Ashland

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Clariant

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Ecolab

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Arakawa Chemical Industries, Ltd

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Harima Chemicals Group, Inc.

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Applied Chemicals International Group

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Solenis

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

SEIKO PMC CORPORATION

- Company Overview

- Type/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

LIST OF TABLES

-

World Population in Major Regions (2023–2030)

-

Global Pulp & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

North America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Europe: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Asia-Pacific: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Middle East & Africa: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Latin America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Global Pulp & Pulp & Paper Chemicals Market, by Region, 2023–2030

-

North America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Europe: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table11 Asia-Pacific: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table13 Middle East & Africa: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table12 Latin America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table14 North America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table13 Europe: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table14 Asia-Pacific: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table16 Middle East & Africa: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table15 Latin America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Pulp & Paper Chemicals Market, by Region, 2023–2030

-

Table25 North America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table26 North America: Pulp & Pulp & Paper Chemicals Market, by Type, 2023–2030

-

Table27 North America: Pulp & Pulp & Paper Chemicals Market, by Application, 2023–2030

-

Table28 Europe: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table29 Europe: Pulp & Pulp & Paper Chemicals Market, by Type, 2023–2030

-

Table30 Europe: Pulp & Pulp & Paper Chemicals Market, by Application, 2023–2030

-

Table31 Asia-Pacific: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table32 Asia-Pacific: Pulp & Pulp & Paper Chemicals Market, by Type, 2023–2030

-

Table33 Asia-Pacific: Pulp & Pulp & Paper Chemicals Market, by Application, 2023–2030

-

Table36 Middle East & Africa: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table37 Middle East & Africa Pulp & Pulp & Paper Chemicals Market, by Type, 2023–2030

-

Table33 Middle East & Africa: Pulp & Pulp & Paper Chemicals Market, by Application, 2023–2030

-

Table34 Latin America: Pulp & Pulp & Paper Chemicals Market, by Country, 2023–2030

-

Table35 Latin America Pulp & Pulp & Paper Chemicals Market, by Type, 2023–2030

-

Table33 Latin America: Pulp & Pulp & Paper Chemicals Market, by Application, 2023–2030

-

LIST OF FIGURES

-

Global Pulp & Paper Chemicals Market Segmentation

-

Forecast Methodology

-

Five Forces Analysis of Global Pulp & Paper Chemicals Market

-

Value Chain of Global Pulp & Paper Chemicals Market

-

Share of Global Pulp & Pulp & Paper Chemicals Market, by Country (%)

-

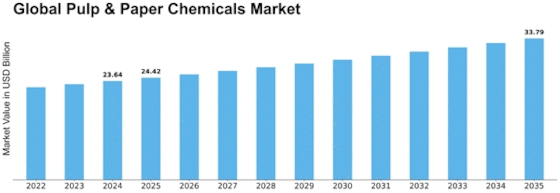

Global Pulp & Paper Chemicals Market, 2023–2030,

-

Sub-Segments of Type, 2023

-

Global Pulp & Pulp & Paper Chemicals Market, by Type, 2023

-

Share of Global Pulp & Pulp & Paper Chemicals Market, by Type, 2023–2030

-

Sub-Segments of Application

-

Global Pulp & Pulp & Paper Chemicals Market, by Application, 2023

-

Share of Global Pulp & Pulp & Paper Chemicals Market, by Application, 2023–2030

Leave a Comment