Regulatory Compliance

Regulatory compliance is increasingly becoming a pivotal factor influencing the Pulp & Paper Chemicals Market. Governments worldwide are implementing stringent regulations aimed at reducing environmental impact and promoting sustainable practices. Compliance with these regulations often necessitates the use of specific chemicals that meet safety and environmental standards. For example, the introduction of regulations limiting the use of harmful substances in paper production has led to a surge in demand for compliant chemical alternatives. Market analysis suggests that the regulatory landscape could drive a 20% increase in the demand for eco-friendly chemicals over the next few years. Consequently, manufacturers are compelled to adapt their chemical offerings to align with these regulations, thereby shaping the dynamics of the Pulp & Paper Chemicals Market.

Sustainability Initiatives

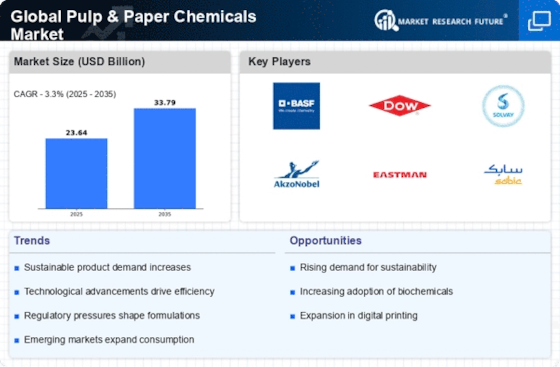

The increasing emphasis on sustainability within the pulp and paper industry appears to be a driving force for the Pulp & Paper Chemicals Market. Companies are increasingly adopting eco-friendly practices, which include the use of biodegradable chemicals and sustainable sourcing of raw materials. This shift is likely to enhance the demand for specialty chemicals that support sustainable production processes. According to recent data, the market for biodegradable chemicals is projected to grow at a compound annual growth rate of 10% over the next five years. As consumers become more environmentally conscious, manufacturers are compelled to innovate and invest in sustainable solutions, thereby propelling the growth of the Pulp & Paper Chemicals Market.

Technological Advancements

Technological advancements in the pulp and paper sector are likely to play a crucial role in shaping the Pulp & Paper Chemicals Market. Innovations such as digitalization, automation, and advanced chemical formulations are enhancing production efficiency and reducing waste. For instance, the introduction of nanotechnology in chemical applications is expected to improve the performance of pulp and paper products significantly. Market data indicates that the adoption of advanced technologies could lead to a 15% reduction in production costs, making it an attractive proposition for manufacturers. As these technologies become more prevalent, they are expected to drive the demand for specialized chemicals that cater to new production methods, thereby influencing the Pulp & Paper Chemicals Market.

Emerging Markets and Economic Growth

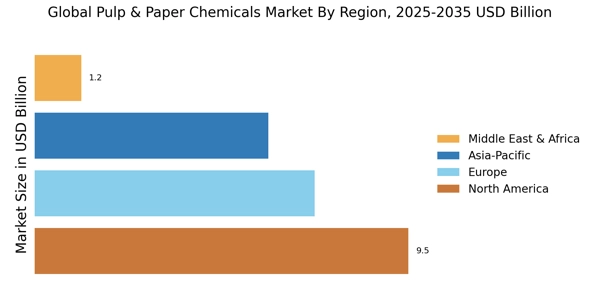

Emerging markets are experiencing rapid economic growth, which appears to be a key driver for the Pulp & Paper Chemicals Market. As these economies develop, there is a corresponding increase in demand for paper products, including packaging, printing, and hygiene products. This growth is likely to stimulate the need for various chemicals used in pulp and paper production. For instance, countries in Asia-Pacific are projected to witness a 7% annual growth rate in paper consumption over the next five years. Consequently, manufacturers are focusing on expanding their operations in these regions to capitalize on the burgeoning demand, thereby influencing the dynamics of the Pulp & Paper Chemicals Market.

Rising Demand for Packaging Solutions

The rising demand for packaging solutions is likely to be a significant driver for the Pulp & Paper Chemicals Market. With the growth of e-commerce and retail sectors, there is an increasing need for sustainable and efficient packaging materials. This trend is pushing manufacturers to seek innovative chemical solutions that enhance the performance and sustainability of packaging products. Market data indicates that The Global Pulp & Paper Chemicals Market is expected to reach USD 500 billion by 2026, which could translate into increased demand for pulp and paper chemicals used in packaging applications. As companies strive to meet consumer preferences for eco-friendly packaging, the Pulp & Paper Chemicals Market is poised for substantial growth.