Cost Efficiency

Cost efficiency remains a pivotal driver in the Pulp and Paper Enzyme Market. Manufacturers are under constant pressure to reduce production costs while maintaining product quality. Enzymes offer a viable solution by enhancing process efficiency and reducing the need for expensive chemicals. The use of enzymes can lead to lower energy consumption and waste generation, translating into significant cost savings. As the industry faces rising raw material prices, the adoption of enzyme technology is likely to become more attractive. Furthermore, the potential for enzymes to improve yield and reduce downtime in production processes may further incentivize their use. This focus on cost efficiency is expected to bolster the growth of the enzyme market, as companies seek to optimize their operations.

Consumer Preferences

Consumer preferences are evolving, significantly impacting the Pulp and Paper Enzyme Market. There is a growing demand for high-quality, sustainable paper products among consumers. This shift is prompting manufacturers to seek innovative solutions that enhance product quality while adhering to environmental standards. Enzymes are increasingly recognized for their ability to improve the strength, brightness, and overall quality of paper. As consumers become more environmentally conscious, they are likely to favor products that utilize eco-friendly production methods. This trend is expected to drive the adoption of enzymes in the pulp and paper sector, as companies strive to meet consumer expectations. The market is anticipated to witness a notable increase in enzyme usage, reflecting the changing dynamics of consumer behavior.

Regulatory Compliance

Regulatory compliance is a significant driver in the Pulp and Paper Enzyme Market. Governments worldwide are implementing stringent regulations to reduce environmental impact and promote sustainable practices. These regulations often mandate the use of environmentally friendly processes in pulp and paper production. Enzymes, being biodegradable and less harmful than traditional chemicals, are increasingly favored in compliance strategies. Companies that adopt enzyme-based solutions can not only meet regulatory requirements but also enhance their market competitiveness. The growing emphasis on compliance is likely to stimulate demand for enzymes, as manufacturers seek to align their operations with environmental standards. This trend may lead to an increase in enzyme adoption rates, further solidifying their role in the industry.

Technological Innovations

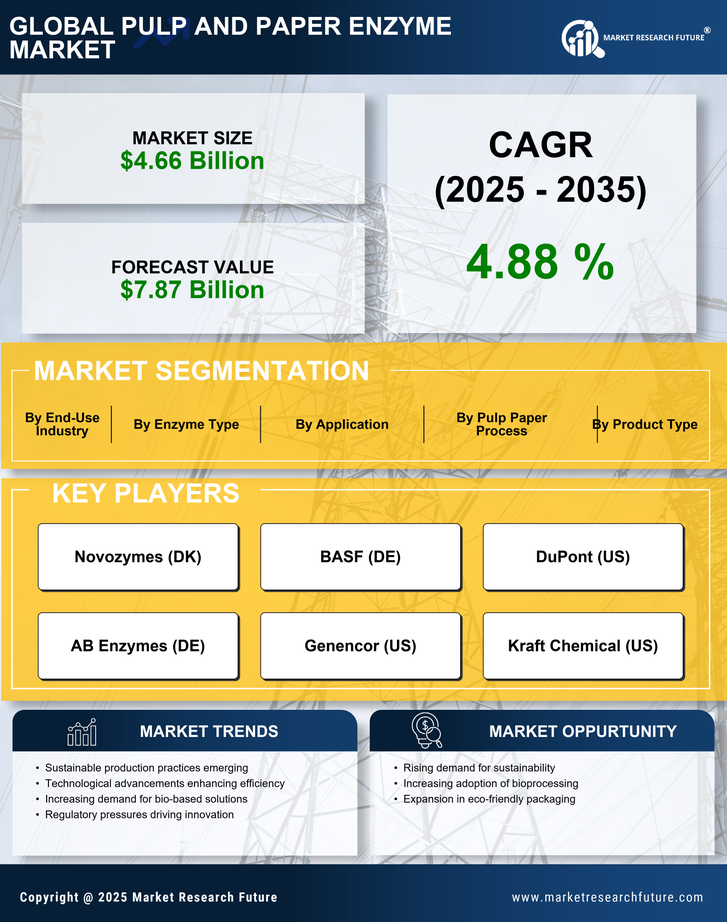

Technological innovations are reshaping the Pulp and Paper Enzyme Market. Advances in enzyme engineering and biotechnology have led to the development of more efficient and specialized enzymes. These innovations enable better performance in pulp bleaching, fiber modification, and waste reduction. The market is witnessing a surge in research and development activities aimed at optimizing enzyme formulations for specific applications. For instance, the introduction of cellulases and xylanases has improved the quality of paper products while reducing production costs. The integration of automation and digital technologies in enzyme production processes is also enhancing efficiency. As a result, the enzyme market is expected to expand, with a projected value reaching several billion dollars in the coming years.

Sustainability Initiatives

The Pulp and Paper Enzyme Market is increasingly influenced by sustainability initiatives. As environmental concerns rise, manufacturers are compelled to adopt eco-friendly practices. Enzymes play a crucial role in reducing chemical usage and energy consumption during pulp processing. The market for enzymes is projected to grow, with estimates suggesting a compound annual growth rate of around 6% over the next few years. This growth is driven by the need for sustainable production methods that minimize waste and emissions. Companies are investing in enzyme technology to enhance the biodegradability of paper products, aligning with global sustainability goals. The shift towards renewable resources and biodegradable materials is likely to further propel the demand for enzymes in the pulp and paper sector.