Increasing Use in Fertilizers

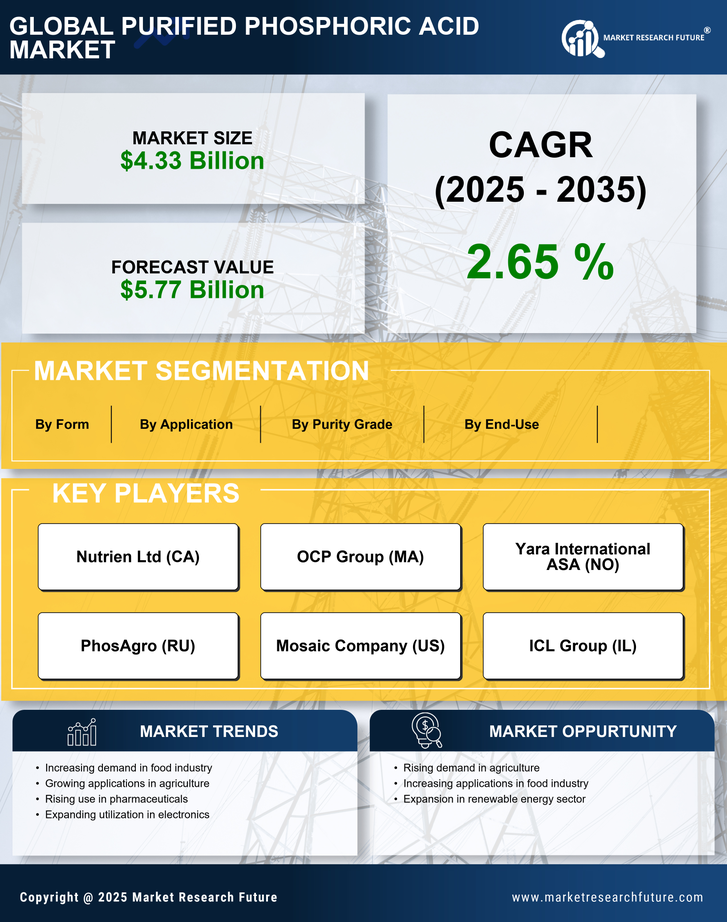

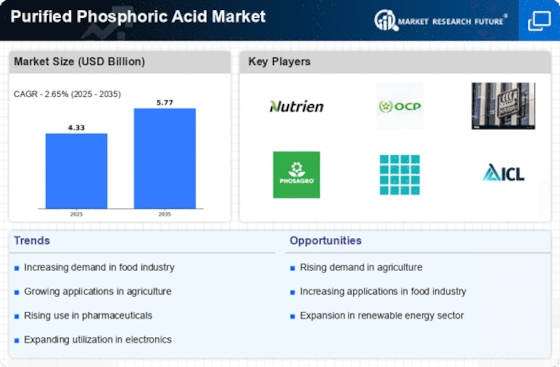

The Purified Phosphoric Acid Market is experiencing a notable surge in demand due to its critical role in the production of fertilizers. Phosphoric acid is a key ingredient in the formulation of phosphate fertilizers, which are essential for enhancing crop yields. As agricultural practices evolve, the need for efficient fertilizers has become paramount. In recent years, the fertilizer segment has accounted for a substantial share of the phosphoric acid market, with estimates suggesting that it constitutes over 70% of total consumption. This trend is likely to continue as the global population grows, necessitating increased food production and, consequently, higher fertilizer usage. The Purified Phosphoric Acid Market is thus poised for growth, driven by the agricultural sector's ongoing expansion and the increasing emphasis on food security.

Growth in the Pharmaceutical Sector

The Purified Phosphoric Acid Market is benefiting from the expansion of the pharmaceutical sector, where purified phosphoric acid is utilized in various applications. It is a vital component in the synthesis of active pharmaceutical ingredients and serves as a pH adjuster in formulations. The pharmaceutical industry has been experiencing steady growth, with projections indicating a compound annual growth rate of around 5%. This growth is likely to drive increased demand for purified phosphoric acid, as pharmaceutical companies seek high-quality raw materials to ensure product efficacy and safety. Consequently, the Purified Phosphoric Acid Market stands to gain from the ongoing advancements and innovations within the pharmaceutical landscape.

Rising Demand in Industrial Applications

The Purified Phosphoric Acid Market is witnessing a significant uptick in demand from various industrial applications. Industries such as food processing, pharmaceuticals, and electronics utilize purified phosphoric acid for its properties as an acidulant, pH regulator, and cleaning agent. For instance, in the food industry, it is employed to enhance flavor and preserve products, while in pharmaceuticals, it serves as a crucial ingredient in the formulation of various medications. The industrial segment has shown a growth rate of approximately 4% annually, indicating a robust market potential. As industries continue to innovate and expand, the reliance on purified phosphoric acid is expected to increase, further propelling the market forward.

Technological Innovations in Production Processes

The Purified Phosphoric Acid Market is being shaped by technological innovations that enhance production efficiency and product quality. Advances in production techniques, such as improved filtration and crystallization methods, are enabling manufacturers to produce higher purity phosphoric acid with reduced energy consumption. These innovations not only lower production costs but also minimize environmental impact, aligning with the growing emphasis on sustainability. As technology continues to evolve, the market is likely to witness a shift towards more efficient and eco-friendly production processes. This trend may attract new entrants into the Purified Phosphoric Acid Market, fostering competition and driving further advancements in product offerings.

Environmental Regulations and Sustainability Initiatives

The Purified Phosphoric Acid Market is increasingly influenced by stringent environmental regulations and sustainability initiatives. Governments and regulatory bodies are imposing stricter guidelines on chemical production and usage, prompting manufacturers to adopt cleaner and more sustainable practices. This shift is leading to the development of eco-friendly phosphoric acid production methods, which not only comply with regulations but also appeal to environmentally conscious consumers. The market is likely to see a rise in demand for sustainably produced purified phosphoric acid, as companies strive to enhance their green credentials. This trend may create new opportunities for innovation within the Purified Phosphoric Acid Market, as stakeholders seek to balance profitability with environmental responsibility.