Quartz Size

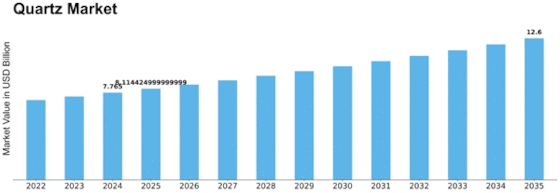

Quartz Market Growth Projections and Opportunities

The Quartz market is influenced by various factors that shape its dynamics and growth patterns. One significant factor is the increasing demand for quartz in various industries, including electronics, construction, and automotive. Quartz is a versatile mineral with unique properties such as high hardness, durability, and chemical inertness, making it highly desirable for use in a wide range of applications. In the electronics industry, quartz is used in the production of quartz crystals and oscillators for timing and frequency control in electronic devices such as smartphones, computers, and telecommunications equipment. In the construction industry, quartz is used as a key ingredient in the production of engineered stone countertops, tiles, and flooring due to its durability and aesthetic appeal. Similarly, in the automotive industry, quartz is used in the manufacturing of glass windows, headlights, and other automotive components, driving market growth.

Moreover, technological advancements play a crucial role in shaping the Quartz market. Continuous innovation in quartz mining, processing, and refining technologies has led to improvements in production efficiency, product quality, and cost-effectiveness. Advanced techniques such as high-purity quartz purification and crystal growth enable manufacturers to produce high-quality quartz products that meet the stringent requirements of various industries, driving market expansion and adoption of quartz-based products.

Another key factor influencing the Quartz market is the growing demand for sustainable and eco-friendly materials. As consumers become increasingly environmentally conscious, there is a growing preference for materials that are sourced and processed in an environmentally responsible manner. Quartz is considered a sustainable material as it is abundant in nature and can be mined and processed with minimal environmental impact. Manufacturers are responding to this demand by implementing sustainable mining practices, reducing energy consumption, and minimizing waste generation, driving market growth.

Market regulations and standards also impact the Quartz market. Quartz products used in critical applications such as electronics and aerospace must comply with stringent quality and performance standards set by regulatory agencies and industry organizations. Compliance with these standards is essential for manufacturers to ensure product reliability, safety, and market acceptance. Additionally, regulations governing mining practices, environmental protection, and occupational health and safety influence the operations of quartz mining and processing companies, shaping market dynamics.

Furthermore, market competition drives innovation and product development in the Quartz market. The market is highly competitive, with numerous manufacturers competing for market share by offering a wide range of quartz products tailored to specific industry requirements and performance standards. Competitive pricing strategies, product differentiation, and marketing initiatives drive market competition and influence consumer purchasing decisions.

Economic factors also play a significant role in shaping the Quartz market. Economic conditions such as GDP growth, construction activity, industrial production, and consumer spending influence demand for quartz products across various industries. During periods of economic expansion, increased construction activity, infrastructure investment, and consumer spending drive demand for quartz products, while economic downturns may lead to temporary slowdowns in market growth as industries scale back production and investment.

Moreover, the availability and cost of raw materials impact the production and pricing of quartz products. Quartz is primarily mined from natural deposits, and its availability depends on factors such as geological conditions, mining regulations, and market demand. Fluctuations in raw material prices, supply chain disruptions, and geopolitical factors can affect production costs and profit margins for quartz manufacturers, influencing market dynamics.

Global market trends and geopolitical factors also influence the Quartz market. Factors such as trade policies, tariffs, currency exchange rates, and geopolitical tensions can impact market dynamics, trade flows, and supply chain logistics, affecting the availability and pricing of quartz products in different regions. Additionally, technological advancements, changing consumer preferences, and industry consolidation shape the competitive landscape and market opportunities in the Quartz market.

Leave a Comment