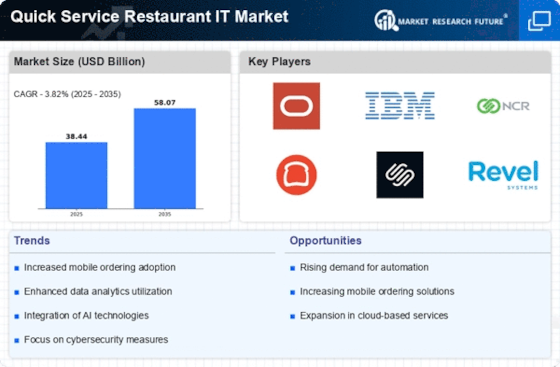

Rise of Digital Transformation

The Quick Service Restaurant IT Market is experiencing a notable rise in digital transformation initiatives. As consumer preferences shift towards technology-driven solutions, restaurants are increasingly adopting IT systems that enhance operational efficiency and customer engagement. According to recent data, approximately 70% of quick service restaurants have implemented some form of digital technology, such as point-of-sale systems and online ordering platforms. This trend indicates a growing recognition of the importance of technology in meeting customer expectations and streamlining operations. Furthermore, the integration of advanced analytics tools allows restaurants to gain insights into customer behavior, enabling them to tailor their offerings more effectively. As a result, the Quick Service Restaurant IT Market is likely to continue evolving, driven by the need for innovative solutions that enhance the overall dining experience.

Growing Importance of Data Analytics

The Quick Service Restaurant IT Market is witnessing a growing importance of data analytics in decision-making processes. With the increasing volume of data generated from various sources, restaurants are leveraging analytics tools to gain actionable insights into customer preferences and operational performance. Recent statistics suggest that restaurants utilizing data analytics can improve their sales by up to 15%, as they are better equipped to understand market trends and customer behavior. This analytical approach enables quick service restaurants to optimize their menu offerings, pricing strategies, and marketing campaigns. Furthermore, the ability to analyze customer feedback in real-time allows restaurants to make informed adjustments to enhance customer satisfaction. As data analytics becomes more integral to operational strategies, the Quick Service Restaurant IT Market is likely to see a surge in investments in advanced analytics technologies.

Expansion of Delivery and Takeout Services

The Quick Service Restaurant IT Market is currently experiencing an expansion of delivery and takeout services, driven by changing consumer habits. Recent data indicates that nearly 50% of quick service restaurant sales now come from delivery and takeout channels. This shift has prompted restaurants to invest in IT solutions that facilitate efficient order management and delivery logistics. The integration of third-party delivery platforms and in-house delivery systems has become essential for maintaining competitiveness in this evolving landscape. Additionally, the rise of ghost kitchens, which focus solely on delivery, further underscores the need for robust IT infrastructure to support these operations. As the demand for delivery and takeout continues to grow, the Quick Service Restaurant IT Market is expected to adapt by enhancing its technological capabilities to meet consumer expectations.

Increased Demand for Contactless Solutions

In the Quick Service Restaurant IT Market, there is a marked increase in demand for contactless solutions. This trend is largely driven by consumer preferences for convenience and safety. Recent surveys indicate that over 60% of customers prefer contactless payment options, which has prompted restaurants to invest in mobile payment technologies and self-service kiosks. These solutions not only enhance the customer experience but also improve operational efficiency by reducing wait times and minimizing human interaction. Additionally, the implementation of contactless ordering systems allows restaurants to streamline their service processes, thereby increasing throughput. As the demand for contactless solutions continues to rise, the Quick Service Restaurant IT Market is expected to adapt by integrating more advanced technologies that cater to these evolving consumer preferences.

Emphasis on Customer Experience Enhancement

In the Quick Service Restaurant IT Market, there is a strong emphasis on enhancing customer experience through technology. Restaurants are increasingly recognizing that a positive customer experience is crucial for retaining clientele and driving repeat business. Recent studies show that establishments that prioritize customer experience can see a revenue increase of up to 20%. This has led to the adoption of various IT solutions, such as personalized marketing, loyalty programs, and interactive digital menus. By leveraging customer data, restaurants can tailor their offerings and communication strategies to meet individual preferences. Moreover, the integration of feedback mechanisms allows for real-time adjustments to service delivery, further enhancing customer satisfaction. As the focus on customer experience intensifies, the Quick Service Restaurant IT Market is likely to see continued investment in technologies that foster deeper customer engagement.