Radar Sensors Size

Market Size Snapshot

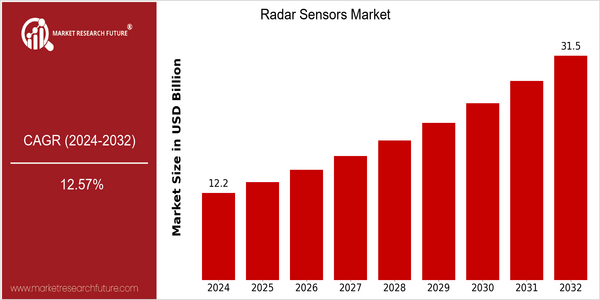

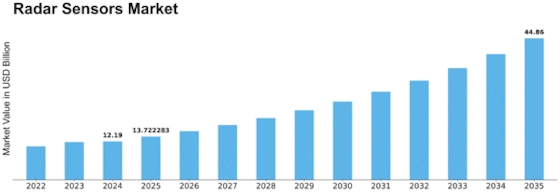

| Year | Value |

|---|---|

| 2024 | USD 12.1925325 Billion |

| 2032 | USD 31.45808 Billion |

| CAGR (2024-2032) | 12.57 % |

Note – Market size depicts the revenue generated over the financial year

The global radar sensors market is poised for significant growth, with a current market size of approximately USD 12.19 billion in 2024, projected to expand to USD 31.46 billion by 2032. This robust growth trajectory reflects a compound annual growth rate (CAGR) of 12.57% over the forecast period. The increasing demand for advanced sensing technologies across various sectors, including automotive, aerospace, and defense, is a primary driver of this market expansion. As industries increasingly adopt automation and smart technologies, radar sensors are becoming essential for applications such as collision avoidance, traffic monitoring, and environmental sensing.

Technological advancements, particularly in the miniaturization of radar systems and the integration of artificial intelligence, are further propelling market growth. Companies like Texas Instruments, Raytheon Technologies, and Bosch are at the forefront of innovation, investing in research and development to enhance radar sensor capabilities. Strategic initiatives, such as partnerships for developing next-generation radar technologies and product launches aimed at expanding application areas, are also contributing to the market's dynamic landscape. As the demand for safety and efficiency in various applications continues to rise, the radar sensors market is expected to thrive in the coming years.

Regional Market Size

Regional Deep Dive

The Radar Sensors Market is experiencing significant growth across various regions, driven by advancements in technology, increasing demand for automation, and the rising need for safety and security in various applications. Each region exhibits unique characteristics influenced by local economic conditions, regulatory frameworks, and technological adoption rates. North America leads in innovation and deployment, while Europe focuses on regulatory compliance and sustainability. Asia-Pacific is rapidly expanding due to industrialization and urbanization, while the Middle East and Africa are witnessing growth through investments in infrastructure and defense. Latin America is gradually adopting radar technologies, influenced by economic development and modernization efforts.

Europe

- The European Union has implemented stringent regulations on automotive safety, pushing manufacturers to adopt radar sensors for advanced driver-assistance systems (ADAS), thereby expanding the market.

- Key players such as Bosch and Continental are investing in R&D to develop next-generation radar sensors that comply with these regulations, enhancing vehicle safety and performance.

Asia Pacific

- China's rapid urbanization and industrial growth have led to increased demand for radar sensors in smart city projects, with significant investments from the government in infrastructure development.

- Companies like NEC Corporation and Mitsubishi Electric are innovating in radar technology for applications in transportation and security, contributing to the region's market expansion.

Latin America

- Brazil is focusing on modernizing its transportation infrastructure, which includes the integration of radar sensors for traffic monitoring and control systems.

- Government initiatives aimed at improving public safety are driving the adoption of radar technologies in law enforcement and surveillance applications.

North America

- The U.S. Department of Defense has increased its investment in radar technologies, particularly for defense applications, which is expected to drive innovation and market growth in the region.

- Companies like Raytheon Technologies and Northrop Grumman are leading the development of advanced radar systems, focusing on integrating artificial intelligence to enhance detection capabilities.

Middle East And Africa

- The UAE is investing heavily in smart city initiatives, which include the deployment of radar sensors for traffic management and security, indicating a growing market potential.

- Local companies, such as Emirates Defense Industries Company, are collaborating with international firms to enhance radar technology capabilities for defense and surveillance applications.

Did You Know?

“Radar sensors can detect objects at distances of up to several hundred kilometers, making them essential for applications ranging from aviation to automotive safety.” — National Aeronautics and Space Administration (NASA)

Segmental Market Size

The Radar Sensors Market is experiencing robust growth, driven by increasing demand for advanced sensing technologies across various industries. Key factors propelling this segment include the rising need for safety and automation in automotive applications, as well as the growing adoption of radar systems in aerospace and defense for surveillance and navigation. Additionally, regulatory policies promoting vehicle safety standards are further fueling demand for radar sensors in automotive applications.

Currently, the adoption of radar sensors is in the scaled deployment stage, with notable examples including companies like Bosch and Continental, which are integrating radar technology into their advanced driver-assistance systems (ADAS). Primary applications of radar sensors encompass automotive collision avoidance systems, air traffic control, and industrial automation, showcasing their versatility across sectors. Trends such as the push for smart city initiatives and sustainability efforts are accelerating growth, as radar sensors contribute to efficient traffic management and energy conservation. Technologies like millimeter-wave radar and frequency-modulated continuous wave (FMCW) are shaping the segment's evolution, enhancing detection capabilities and accuracy.

Future Outlook

The Radar Sensors Market is poised for significant growth from 2024 to 2032, with a projected market value increase from approximately $12.19 billion to $31.46 billion, reflecting a robust compound annual growth rate (CAGR) of 12.57%. This growth trajectory is underpinned by the increasing adoption of radar technology across various sectors, including automotive, aerospace, and defense. As industries continue to prioritize safety and automation, the demand for advanced radar sensors, particularly in autonomous vehicles and smart city applications, is expected to surge. By 2032, it is anticipated that radar sensors will penetrate over 30% of the automotive market, driven by regulatory mandates for enhanced safety features and the growing consumer preference for advanced driver-assistance systems (ADAS).

Key technological advancements, such as the integration of artificial intelligence and machine learning with radar systems, are set to enhance the capabilities of these sensors, enabling more accurate object detection and tracking. Additionally, government policies promoting smart infrastructure and sustainable transportation solutions will further catalyze market growth. Emerging trends, including the miniaturization of radar sensors and the development of multi-functional devices, will also play a crucial role in expanding their applications across various industries. As the market evolves, stakeholders must remain agile to leverage these trends and capitalize on the burgeoning opportunities within the radar sensors landscape.

Leave a Comment