Railway Signaling System Size

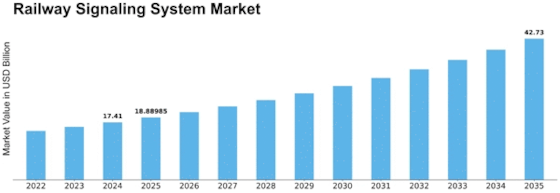

Railway Signaling System Market Growth Projections and Opportunities

The railway signaling system market is influenced by various market factors that shape its growth and dynamics. One of the primary factors driving this market is the increasing demand for safe and efficient railway transportation. As populations grow and urbanization expands, there is a greater need for reliable signaling systems to ensure the safety of passengers and goods being transported by rail. Additionally, governments and regulatory bodies around the world are implementing stricter safety standards, mandating the adoption of advanced signaling technologies to prevent accidents and improve overall operational efficiency.

Moreover, technological advancements play a significant role in shaping the railway signaling system market. The emergence of innovative technologies such as Positive Train Control (PTC), Communication-Based Train Control (CBTC), and European Train Control System (ETCS) has revolutionized the signaling landscape, offering enhanced safety features, better interoperability, and increased automation. These advancements not only address current safety concerns but also future-proof railway networks against evolving challenges.

Furthermore, the growing trend towards digitalization and automation in the transportation sector is driving the adoption of modern signaling solutions. Digital signaling systems enable real-time monitoring, predictive maintenance, and remote control capabilities, leading to improved reliability and operational efficiency. Automation, on the other hand, reduces human errors and streamlines train operations, resulting in smoother traffic flow and optimized scheduling.

Additionally, market factors such as infrastructure development projects, government initiatives, and investments in railway modernization programs significantly impact the growth of the signaling system market. Many countries are investing heavily in upgrading their railway infrastructure to accommodate growing passenger volumes and freight traffic, creating lucrative opportunities for signaling system providers. Government funding and incentives further accelerate the adoption of advanced signaling technologies, especially in regions where safety and efficiency improvements are critical priorities.

Moreover, the competitive landscape and market consolidation play a crucial role in shaping the railway signaling system market. The industry is characterized by the presence of several key players, including multinational corporations and regional suppliers, competing to offer innovative solutions and expand their market share. Mergers, acquisitions, and strategic partnerships are common strategies employed by companies to strengthen their market position, enhance their product portfolios, and access new geographic markets.

Furthermore, market factors such as regulatory compliance, environmental sustainability, and cost-effectiveness influence the decision-making process of railway operators and stakeholders. Regulatory requirements pertaining to safety standards and interoperability drive the adoption of specific signaling technologies, while environmental concerns prompt the development of energy-efficient and eco-friendly solutions. Cost considerations also play a significant role, with railway operators seeking cost-effective signaling solutions that offer long-term value and return on investment.

In conclusion, the railway signaling system market is shaped by various market factors, including increasing safety demands, technological advancements, digitalization trends, infrastructure investments, competitive dynamics, regulatory compliance, environmental sustainability, and cost considerations. As the global transportation landscape continues to evolve, the demand for advanced signaling solutions will remain strong, driving innovation and growth in the railway signaling system market.

Leave a Comment