Market Analysis

In-depth Analysis of Reactive Diluents Market Industry Landscape

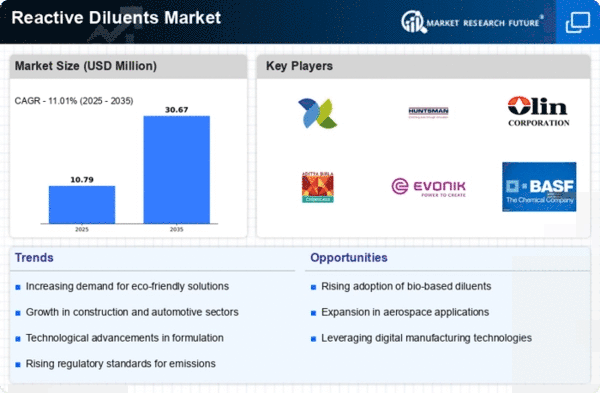

The market dynamics of reactive diluents revolve around a dynamic interplay of various factors that influence supply, demand, and overall industry trends. Reactive diluents play a crucial role in formulating coatings, adhesives, and composites, enhancing their performance and application properties. One key factor driving the market is the growing demand for eco-friendly and sustainable products in industries like paints and coatings. As regulations tighten around volatile organic compounds (VOCs), manufacturers are increasingly turning to reactive diluents as a solution to meet environmental standards.

Another significant driver is the expanding construction and infrastructure sector worldwide. The construction industry's need for durable and high-performance coatings has propelled the demand for reactive diluents, as they contribute to the improvement of coating properties such as hardness, flexibility, and chemical resistance. Moreover, the automotive industry, with its continuous quest for lightweight materials and enhanced performance, has become a prominent consumer of reactive diluents in composite manufacturing.

The market dynamics are also influenced by technological advancements in the manufacturing process of reactive diluents. Continuous research and development efforts are being made to create innovative formulations that offer improved performance and meet specific application requirements. This technological evolution contributes to the overall growth of the reactive diluents market by providing solutions that cater to the ever-evolving needs of end-users.

Price fluctuations of raw materials, such as epoxy resins and acrylic monomers, significantly impact the reactive diluents market dynamics. The volatility in raw material prices can affect the production cost, subsequently influencing the pricing strategies of manufacturers. Economic factors, geopolitical events, and global supply chain disruptions further contribute to the unpredictability of raw material prices, adding a layer of complexity to the market dynamics.

Competitive dynamics within the reactive diluents market are characterized by a mix of large multinational corporations and smaller regional players. Market participants engage in strategic initiatives such as mergers, acquisitions, partnerships, and product launches to gain a competitive edge and expand their market presence. The pursuit of a diverse product portfolio and a strong distribution network are key strategies employed by companies to strengthen their position in the market.

Geographically, the market dynamics vary across regions. Developed economies with stringent environmental regulations, such as North America and Europe, witness a higher adoption of reactive diluents due to their eco-friendly attributes. On the other hand, emerging economies in Asia-Pacific and Latin America experience robust growth in demand, driven by expanding industrial sectors and infrastructure development.

The market dynamics of reactive diluents are also influenced by changing consumer preferences and awareness regarding sustainable practices. End-users are increasingly seeking products with lower VOC content and improved environmental profiles, prompting manufacturers to align their strategies with these evolving preferences.

Leave a Comment