Reactive Diluents Size

Reactive Diluents Market Growth Projections and Opportunities

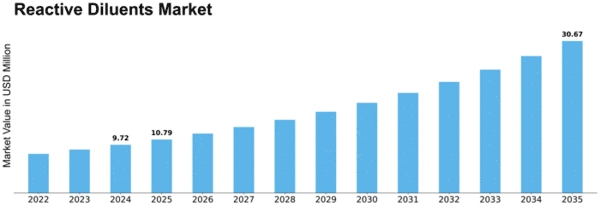

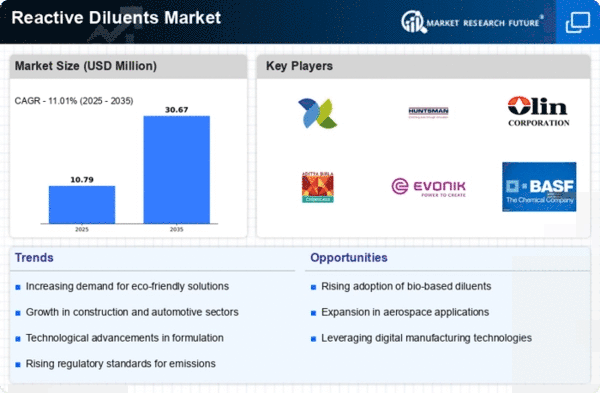

In addition, the worldwide reactive diluents market has been expected to increase at a CAGR of 5.93%, with a value of USD 845 million during the estimated forecasting period of 2021-2030.

The market for reactive diluents is influenced by a myriad of factors that collectively shape its dynamics. One of the primary drivers is the increasing demand from end-use industries such as paints and coatings, adhesives, and composites. As these sectors expand globally, the need for reactive diluents, which serve as viscosity reducers and improve the overall performance of formulations, experiences a parallel growth. The automotive industry, in particular, contributes significantly to this demand, as reactive diluents find applications in the production of lightweight and durable composite materials used in automotive components.

Environmental regulations play a pivotal role in shaping the reactive diluents market. With a growing emphasis on sustainable and eco-friendly products, there is an increasing shift towards low volatile organic compound (VOC) formulations. Reactive diluents, being essential components in formulating low-VOC products, witness heightened demand as industries strive to comply with stringent environmental norms. The push towards greener alternatives is not only a regulatory requirement but also a consumer preference, driving manufacturers to invest in environmentally friendly solutions.

Innovation and technological advancements are key factors propelling the reactive diluents market forward. Continuous research and development efforts are focused on creating novel formulations with enhanced properties, such as improved curing times and better adhesion characteristics. Manufacturers strive to stay ahead in the competitive landscape by introducing products that cater to the evolving needs of various industries. This pursuit of innovation contributes to the overall growth and expansion of the reactive diluents market.

The global economic landscape significantly impacts the reactive diluents market. Economic stability and growth lead to increased investments in construction, automotive, and infrastructure projects, subsequently boosting the demand for coatings and adhesives. Conversely, economic downturns may result in a temporary slowdown in these industries, affecting the demand for reactive diluents. The market is inherently linked to the overall economic health, with fluctuations in economic conditions directly influencing the buying patterns of end-users.

Raw material availability and pricing are crucial considerations for market participants. The primary raw materials for reactive diluents include epoxies, acrylates, and unsaturated polyesters. Fluctuations in the prices of these raw materials can impact the overall production cost of reactive diluents. Manufacturers closely monitor raw material markets to adapt their strategies and maintain cost-effectiveness in the highly competitive reactive diluents market.

Geographical factors also play a role in shaping the reactive diluents market. The concentration of end-use industries in specific regions influences the demand for reactive diluents in those areas. Additionally, regulatory frameworks vary across countries, impacting the market dynamics differently in each region. For instance, regions with stringent environmental regulations may experience a higher demand for low-VOC reactive diluents compared to regions with more lenient standards.

Leave a Comment