Government Initiatives and Investments

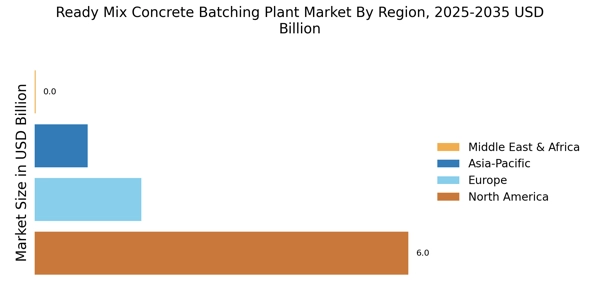

Government initiatives aimed at improving infrastructure are playing a pivotal role in the Ready Mix Concrete Batching Plant Market. Various countries are investing heavily in transportation, housing, and public works projects, which in turn drives the demand for ready mix concrete. For instance, recent government reports indicate that infrastructure spending is expected to increase by 10% in the coming years, creating a favorable environment for the ready mix concrete sector. These investments not only stimulate economic growth but also enhance the operational landscape for ready mix concrete batching plants, as they are essential for supplying concrete to large-scale projects.

Rising Urbanization and Population Growth

Urbanization and population growth are key drivers of the Ready Mix Concrete Batching Plant Market. As more people migrate to urban areas, the demand for housing, commercial spaces, and infrastructure increases. Current estimates suggest that urban populations are expected to rise by 2.5 billion by 2050, necessitating substantial construction efforts. This demographic shift is likely to create a robust demand for ready mix concrete, as it is essential for meeting the needs of modern construction projects. Consequently, the Ready Mix Concrete Batching Plant Market is positioned to experience significant growth as it adapts to the challenges and opportunities presented by urbanization.

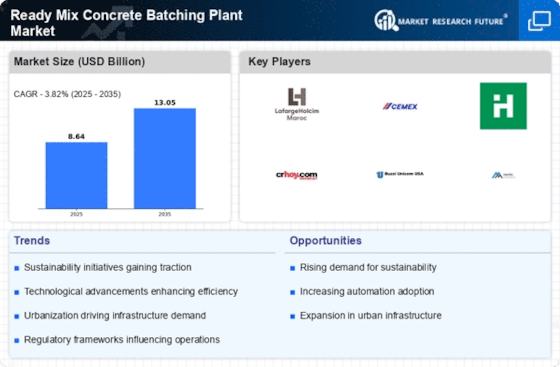

Sustainability and Eco-Friendly Practices

The growing emphasis on sustainability is reshaping the Ready Mix Concrete Batching Plant Market. There is an increasing demand for eco-friendly construction materials and practices, prompting batching plants to adopt sustainable methods. This includes the use of recycled materials and the implementation of energy-efficient processes. Recent studies indicate that the market for green concrete is expected to grow by 20% in the next five years. Consequently, ready mix concrete producers are likely to invest in sustainable technologies to meet regulatory requirements and consumer preferences, thereby enhancing their market position in the Ready Mix Concrete Batching Plant Market.

Increasing Demand for Construction Activities

The Ready Mix Concrete Batching Plant Market is experiencing a surge in demand due to the rising number of construction activities worldwide. This trend is driven by urbanization, population growth, and the need for infrastructure development. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years. This growth is likely to increase the demand for ready mix concrete, as it offers efficiency and quality in construction projects. As a result, the Ready Mix Concrete Batching Plant Market is poised to benefit from this expanding construction landscape, with manufacturers focusing on enhancing production capabilities to meet the growing needs of the market.

Technological Innovations in Concrete Production

Technological advancements are significantly influencing the Ready Mix Concrete Batching Plant Market. Innovations such as automated batching systems, real-time monitoring, and advanced mixing techniques are enhancing the efficiency and quality of concrete production. The integration of smart technologies is expected to improve operational efficiency, reduce waste, and ensure consistent product quality. Market data suggests that the adoption of these technologies could lead to a 15% increase in production efficiency for batching plants. As a result, companies that invest in these innovations are likely to gain a competitive edge in the Ready Mix Concrete Batching Plant Market.