Red Rice Size

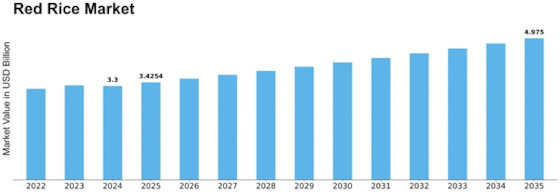

Red Rice Market Growth Projections and Opportunities

The Red Rice market is influenced by a range of market factors that contribute to its growth and dynamics. One key driver is the increasing awareness and demand for healthier and more nutritious food options. Red rice, known for its rich nutritional profile and higher content of antioxidants, fiber, and essential nutrients compared to white rice, has gained popularity among health-conscious consumers. The rising interest in whole grains and ancient grains as part of a balanced diet has propelled the demand for red rice, positioning it as a favorable alternative to traditional white rice.

Furthermore, cultural factors play a significant role in shaping the Red Rice market. Red rice has cultural significance in many Asian countries, where it is a staple food in traditional cuisines. As global culinary diversity gains recognition, consumers are increasingly embracing ethnic foods and exploring new flavors. This cultural appeal contributes to the market growth of red rice, with consumers appreciating the authenticity and heritage associated with this ancient grain.

Economic factors also play a crucial role in influencing the Red Rice market dynamics. The affordability and accessibility of red rice compared to other specialty grains contribute to its widespread adoption. Economic fluctuations, production costs, and global trade patterns impact the pricing and availability of red rice in the market. The market's adaptability to economic changes and its ability to offer a cost-effective yet nutritious food option contribute to its sustained growth.

Moreover, the health and wellness trend is a significant market factor influencing the Red Rice market. Consumers are increasingly seeking foods that align with their health goals, such as weight management, heart health, and overall well-being. Red rice, with its lower glycemic index and higher nutritional content, fits well into these health-conscious preferences. The market responds to this trend by promoting red rice as a wholesome and nutritious choice, emphasizing its benefits in various health and lifestyle publications.

The agricultural and environmental factor is another critical influence on the Red Rice market. Red rice is often cultivated using sustainable and eco-friendly farming practices. The market is responsive to the growing consumer demand for ethically sourced and environmentally friendly products. The emphasis on organic and sustainable agriculture contributes to the appeal of red rice, positioning it as a choice that aligns with environmentally conscious consumer values.

Competition within the rice and grains industry also shapes the Red Rice market. The presence of various rice varieties and specialty grains requires red rice producers to differentiate their products through quality, packaging, and marketing strategies. Strategic collaborations and partnerships within the industry influence market dynamics, with companies aiming to capture a share of the expanding market by offering unique varieties of red rice and innovative product formulations.

Additionally, technological advancements in agriculture and food processing impact the Red Rice market. Innovations in crop management, harvesting techniques, and milling processes contribute to the efficiency and quality of red rice production. Technology also plays a role in packaging and distribution, ensuring that red rice reaches consumers in optimal condition while extending its shelf life.

Leave a Comment