Market Analysis

In-depth Analysis of Refrigerated Truck Rental Market Industry Landscape

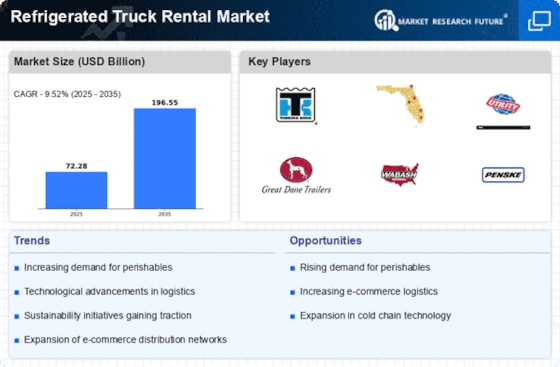

A refrigerated truck rental market is a highly active segment of the industry that is involved in the transportation of perishable items. The dynamics of the market within this sphere are dictated by numerous factors that form its growth and evolution. On this account, the main motive is the fact that the demand for cold chain logistics is growing due to the development of the global food and pharmaceutical industries. As these sectors expand, rising demand for cost-effective and reliable refrigerated transport requires rental services to consider increased production.

Technological advancements are also the cause of a major shift in the market competition of refrigerated truck rentals. Combined refrigeration technologies as well as telematics systems have drastically improved the cooling efficiency and reliability of these vehicles. In real time there will be temperature, humidity and location monitoring, which guarantees cold chain delivery meeting the most delicate parameters.

In addition, the market experienced regulatory changes and environmental considerations. Tighter regulations on the carrying of perishable foodstuff, particularly as it relates to temperature control and emissions requirements, together with the popularity of modern, environmentally friendly refrigerated trucks, increases the demand for such trucks. Companies in this industry are required to be flexible to such regulatory changes and fund the projects aimed at sustainable practices to remain competitive.

The competitive environment, in turn, is the most influential factor in market patterns evolution. Global and regional players in the area of refrigerated truck rental business vie against each other for market share. Affordability, quality of service, and the geographic coverage become significant factors that assist in getting an edge over the competitors. Market consolidation, mergers and acquisitions, despite the fact that companies aim to enhance their capabilities and expand their reach, contribute to the unpredictable dynamics.

Amongst the factors which add up to the dynamics of the refrigerated truck rental market are consumer preferences as well as industry tendencies. Growing consumer sensitivity to the usefulness and safety in perishable items transport has led to greater preference for the rental services with the latest tech and compliance with the industrial standards. Flexibility of rent terms and adaptability in meeting the seasonal demand are some of the important considerations any customer has to make.

The global economic climate and trade patterns are other facets of the market for refrigerated truck rental. With the growing extension of international trade and the globalisation of supply chains, such a thing as cold chain logistics that is effective and reliable has become essential. With the desire to penetrate new markets, businesses raise the need of refrigerated transportation services correlativity which consequently affect the market dynamics.

Leave a Comment