Market Trends

Key Emerging Trends in the Refrigerated Truck Rental Market

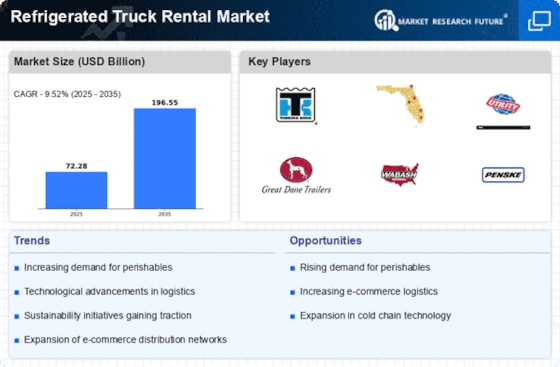

The refrigerated truck rental business has experienced some notable changes in recent times which are the result of coordination of factors that testify to the development of the transport and logistics industry. The most notable among the trends is the increasing need for cold chain solutions especially in food and pharmaceutical industries. With changing consumer preferences towards fresh and diversified products, the role of refrigerated transportation becomes very important. Consequently, businesses require truck rentals that are refrigerated and flexible and cost convenient options which tackle different temperature-sensitive goods.

Another important factor in the growth of refrigerated truck rental industry is the e-commerce and the globalization of supply chains. Because of the rising cross-border movement of perishable goods, the businesses have been embracing rental options as a way of dealing with the complexities that come with shipping temperature sensitive items over long distances. This phenomenon becomes more noticeable in the drug industry, where the delivery of vaccines and other temperature-sensitive meds require the use of controlled and precise environments. An option for the companies that commit to the integrity of their products during the entire supply chain, is the leasing of refrigerated trucks.

Not only the demand for cold chain services but also the sustainability of environment is becoming the major factor in determining the trends in the rental market of refrigerated trucks. On the background of the increased attention to the reduction of carbon dioxide emissions and the use of eco-technologies, there is a growing demand for trucks equipped with sophisticated energy-saving systems. This can include the use of electric or hybrid refrigeration systems as well as the installation of smart monitoring and control systems for the purpose of minimizing the energy consumption. As sustainability becomes a hinge point for most industries, the refrigerated truck rental market is undergoing a transition towards environmentally friendly alternatives.

Another of the market trends that should be noticed is the application of technology to increase the efficiency and visibility. The role of IoT (Internet of Things) devices and telematics can not be overstated in real-time monitoring and tracking of temperature-sensitive cargo. It not only helps in preserving the best environment during haulage but also gives the businesses more leeway in controlling and tracking their supply chains. Technology applies to predictive maintenance, which reduces the risk of breakdowns with the truck and ensures the reliability of the refrigerated truck.

Leave a Comment