Focus on Health and Wellness Trends

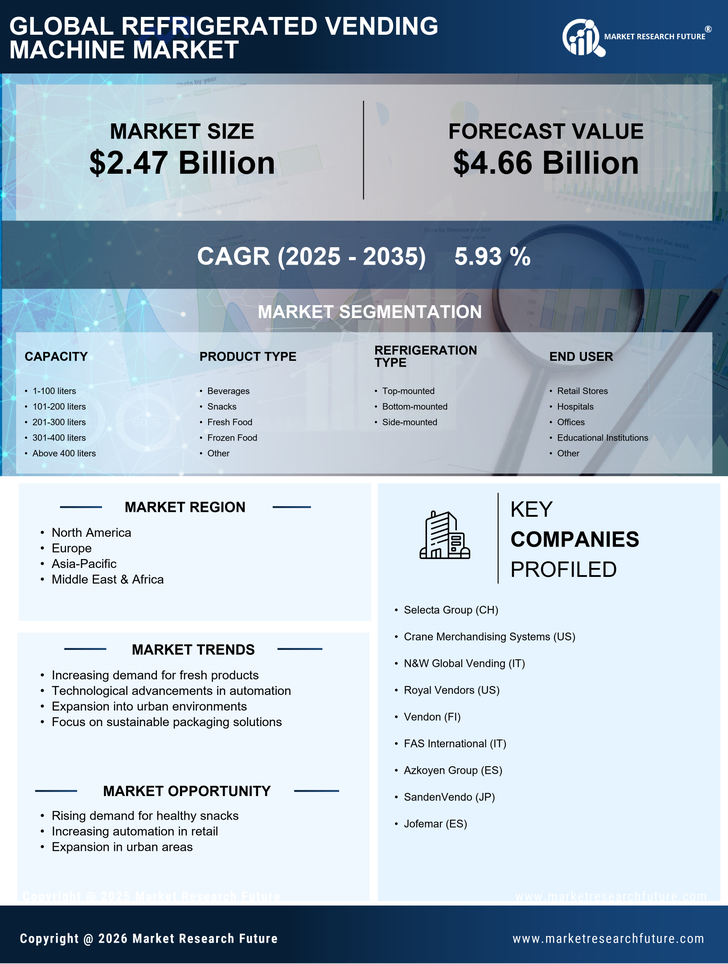

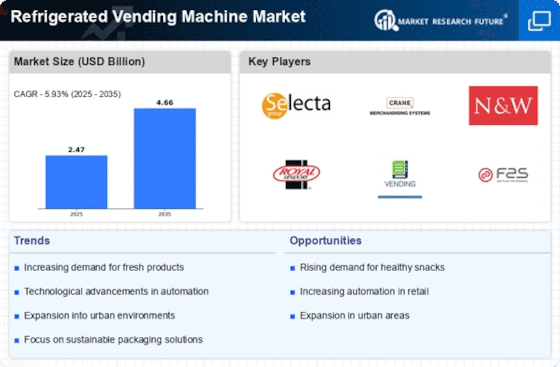

The growing focus on health and wellness is a significant driver for the Refrigerated Vending Machine Market. Consumers are increasingly prioritizing their health, leading to a demand for healthier food options in vending machines. This trend is reflected in the rising sales of organic and natural products, which have seen a growth rate of approximately 6% annually. Refrigerated vending machines that offer fresh fruits, salads, and low-calorie snacks are becoming more popular as they align with consumer preferences for nutritious choices. This shift not only benefits consumers but also provides operators with a competitive edge in the market. As health consciousness continues to rise, the demand for refrigerated vending machines that cater to these preferences is expected to grow.

Expansion of Vending Machine Locations

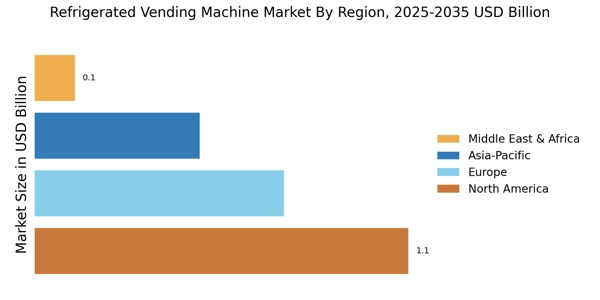

The expansion of vending machine locations is a crucial driver for the Refrigerated Vending Machine Market. As businesses and institutions recognize the value of providing convenient food options, the placement of refrigerated vending machines in high-traffic areas is on the rise. Locations such as office buildings, schools, and hospitals are increasingly incorporating these machines to meet consumer demand. Recent statistics indicate that the number of vending machines in workplaces has increased by 15% over the past year. This trend not only enhances accessibility for consumers but also creates new revenue streams for operators. As more locations adopt refrigerated vending machines, the market is poised for continued growth.

Rising Demand for Convenient Food Options

The increasing demand for convenient food options is a primary driver of the Refrigerated Vending Machine Market. As lifestyles become busier, consumers are seeking quick and accessible meal solutions. This trend is particularly evident in urban areas, where the fast-paced environment necessitates easy access to food. According to recent data, the convenience food sector has seen a growth rate of approximately 4.5% annually, which directly influences the vending machine market. Refrigerated vending machines cater to this need by offering fresh and healthy food choices, thus appealing to a broad demographic. The ability to provide nutritious options in a convenient format positions these machines as a favorable choice for both consumers and operators, further propelling the market forward.

Sustainability and Eco-Friendly Practices

Sustainability is increasingly becoming a focal point in the Refrigerated Vending Machine Market. Consumers are more aware of environmental issues and are seeking products that align with their values. This has led to a rise in demand for eco-friendly vending machines that utilize energy-efficient technologies and sustainable materials. Data suggests that the market for sustainable vending solutions is projected to grow by 25% over the next five years. Companies that adopt green practices not only attract environmentally conscious consumers but also reduce operational costs through energy savings. As sustainability becomes a key consideration for consumers, the demand for refrigerated vending machines that reflect these values is likely to increase.

Technological Advancements in Vending Machines

Technological advancements are significantly shaping the Refrigerated Vending Machine Market. Innovations such as cashless payment systems, touchless interfaces, and smart inventory management are enhancing user experience and operational efficiency. The integration of IoT technology allows for real-time monitoring of stock levels and temperature controls, ensuring product quality and reducing waste. Data indicates that the adoption of smart vending solutions is expected to increase by over 30% in the next few years. These advancements not only improve customer satisfaction but also streamline operations for vendors, making refrigerated vending machines more attractive to businesses. As technology continues to evolve, it is likely that the market will see even more sophisticated solutions that cater to consumer preferences.