Consumer Awareness of Food Quality

There is a growing consumer awareness regarding food quality and ingredient transparency, which significantly impacts the Release Agents in Meat Market. Consumers are increasingly scrutinizing product labels and seeking out meats that are free from artificial additives. This trend has prompted manufacturers to invest in high-quality release agents that align with consumer expectations for natural and clean-label products. Market Research Future indicates that products marketed as 'clean label' are witnessing a sales increase of approximately 10% annually. This shift towards quality and transparency is likely to shape the future landscape of the release agents market, as companies strive to meet these evolving consumer demands.

Expansion of the Food Service Sector

The expansion of the food service sector is a notable driver for the Release Agents in Meat Market. As restaurants and catering services grow in number and scale, the demand for high-quality meat products increases. Release agents play a crucial role in ensuring that meat products maintain their integrity during cooking and serving. The food service industry is projected to grow at a rate of 5% annually, which will likely boost the demand for effective release agents. This growth presents opportunities for manufacturers to innovate and provide tailored solutions that meet the specific needs of food service operators, thereby enhancing the overall market landscape.

Rising Demand for Processed Meat Products

The increasing consumer preference for convenience foods has led to a surge in the demand for processed meat products. This trend is particularly evident in urban areas where busy lifestyles necessitate quick meal solutions. As a result, the Release Agents in Meat Market is experiencing growth, as these agents enhance the quality and shelf life of processed meats. According to recent data, the processed meat segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is likely to drive the demand for effective release agents that ensure optimal product performance and consumer satisfaction.

Innovation in Food Processing Technologies

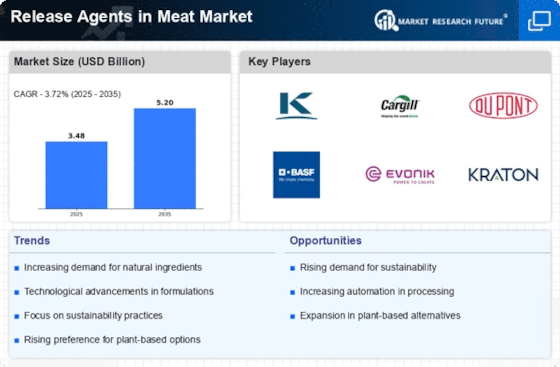

Technological advancements in food processing are reshaping the Release Agents in Meat Market. Innovations such as improved emulsification techniques and the development of plant-based release agents are gaining traction. These advancements not only enhance the efficiency of meat processing but also cater to the evolving consumer preferences for healthier options. The market for plant-based release agents is expected to expand significantly, with estimates suggesting a growth rate of around 6% annually. This innovation-driven landscape indicates a shift towards more sustainable and health-conscious formulations, thereby influencing the overall dynamics of the release agents market.

Regulatory Compliance and Food Safety Standards

The stringent regulatory environment surrounding food safety is a critical driver for the Release Agents in Meat Market. Compliance with regulations such as the Food Safety Modernization Act (FSMA) necessitates the use of safe and effective release agents in meat processing. Manufacturers are increasingly focusing on sourcing agents that meet these safety standards, which in turn drives market growth. The emphasis on traceability and transparency in food production is likely to further propel the demand for compliant release agents. As the industry adapts to these regulations, the market for release agents is expected to witness a steady increase, reflecting the importance of safety in consumer choices.