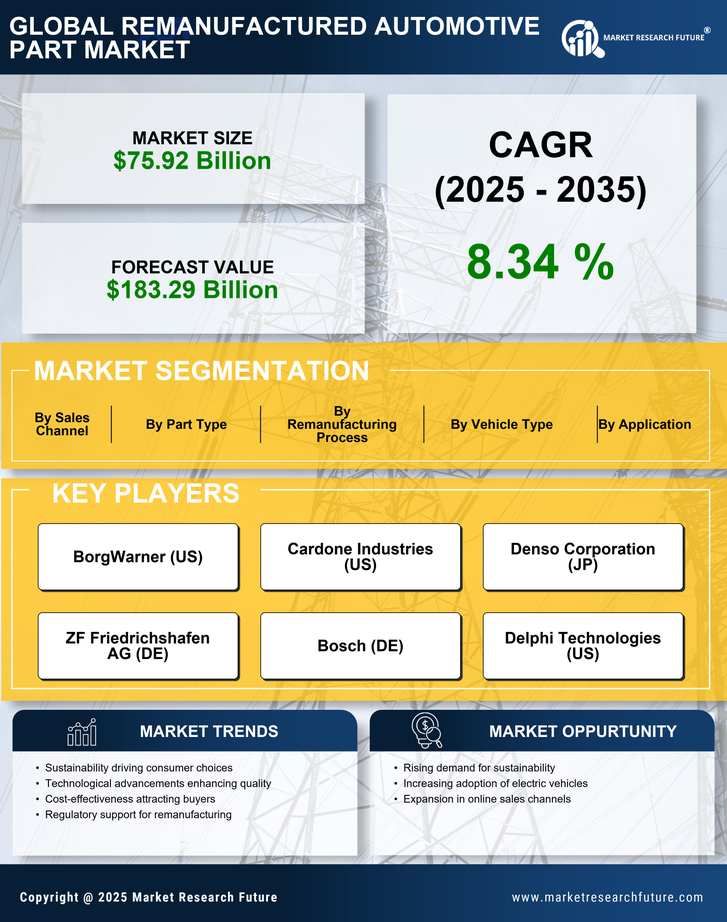

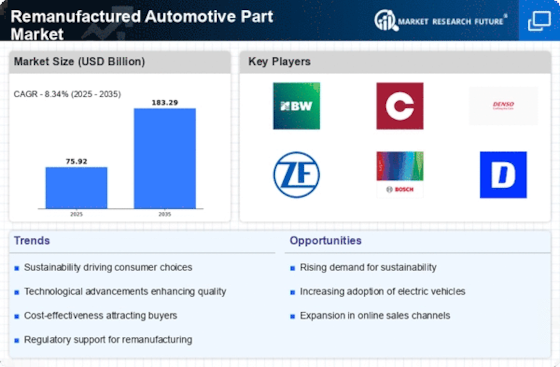

Cost-Effectiveness

Cost considerations are a significant driver for the Remanufactured Automotive Part Market. Remanufactured parts typically offer a more affordable alternative to new components, appealing to budget-conscious consumers and businesses. The average cost savings can range from 30% to 50%, depending on the part and its application. This financial advantage is particularly relevant in an era where economic pressures are prevalent. Additionally, the longevity and reliability of remanufactured parts can lead to reduced maintenance costs over time, further enhancing their appeal. As consumers seek value without compromising quality, the Remanufactured Automotive Part Market is likely to experience sustained growth driven by this cost-effectiveness.

Regulatory Support

Regulatory frameworks are increasingly supportive of the Remanufactured Automotive Part Market, which may serve as a catalyst for growth. Governments are implementing policies that encourage the use of remanufactured parts as part of broader sustainability and waste reduction initiatives. For example, tax incentives and subsidies for companies that utilize remanufactured components can stimulate demand. Additionally, regulations aimed at reducing landfill waste and promoting recycling are likely to favor the remanufacturing sector. As these policies gain traction, the Remanufactured Automotive Part Market could see enhanced legitimacy and consumer trust, further driving market expansion.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Remanufactured Automotive Part Market. As consumers and manufacturers alike become more environmentally conscious, the demand for remanufactured parts is likely to rise. These parts contribute to reduced waste and lower carbon footprints, aligning with global sustainability goals. In fact, remanufacturing can save up to 85% of the energy required to produce new parts, making it an attractive option for eco-friendly consumers. Furthermore, regulatory frameworks are increasingly favoring sustainable practices, which may further bolster the market. The Remanufactured Automotive Part Market is thus positioned to benefit from this trend, as companies that prioritize sustainability may gain a competitive edge.

Technological Advancements

Technological innovations are reshaping the landscape of the Remanufactured Automotive Part Market. Advances in manufacturing processes, such as precision machining and automated quality control, enhance the quality and reliability of remanufactured parts. These improvements not only increase consumer confidence but also expand the range of components that can be effectively remanufactured. For instance, the integration of advanced materials and techniques allows for the remanufacturing of complex electronic components, which were previously challenging. As technology continues to evolve, the market is expected to see an influx of high-quality remanufactured parts, potentially increasing market share and consumer acceptance. This trend indicates a promising future for the Remanufactured Automotive Part Market.

Consumer Awareness and Education

Consumer awareness regarding the benefits of remanufactured parts is gradually increasing, which appears to be a crucial driver for the Remanufactured Automotive Part Market. Educational campaigns and marketing efforts are helping to inform consumers about the quality, reliability, and environmental benefits of remanufactured components. As consumers become more knowledgeable, they may be more inclined to choose remanufactured parts over new ones, particularly in light of the cost savings and sustainability aspects. This growing awareness could lead to a shift in consumer behavior, favoring remanufactured options. Consequently, the Remanufactured Automotive Part Market is likely to benefit from this trend as it aligns with evolving consumer preferences.