Rising Natural Gas Consumption

The rising consumption of natural gas is a pivotal driver for the Residential AMI Gas Meter Market. As more households transition from traditional energy sources to natural gas for heating and cooking, the demand for accurate and efficient metering solutions is escalating. Data suggests that natural gas consumption has increased by approximately 10% over the past five years, driven by its affordability and lower environmental impact compared to other fossil fuels. This trend is expected to continue, further propelling the need for advanced metering technologies that can accurately track usage and support efficient energy management in residential settings.

Enhanced Data Analytics Capabilities

Enhanced data analytics capabilities are transforming the Residential AMI Gas Meter Market. The advent of big data and advanced analytics allows utility companies to gain deeper insights into consumption patterns and customer behavior. By leveraging these insights, utilities can optimize their operations, improve customer service, and develop targeted energy-saving programs. The ability to analyze vast amounts of data in real-time is likely to lead to more personalized services for consumers, fostering greater engagement and satisfaction. As data analytics continues to evolve, it is expected to play a critical role in the ongoing development and adoption of AMI gas meters in residential applications.

Government Initiatives and Incentives

Government initiatives and incentives play a crucial role in shaping the Residential AMI Gas Meter Market. Many governments are implementing policies aimed at promoting the adoption of smart metering technologies to enhance energy management and reduce carbon emissions. For instance, various regions have introduced financial incentives for households that install AMI gas meters, which can significantly lower the initial investment barrier. This support is likely to accelerate the transition towards smart metering solutions, as evidenced by the increase in installations reported in recent years. Such initiatives not only foster market growth but also align with broader sustainability goals.

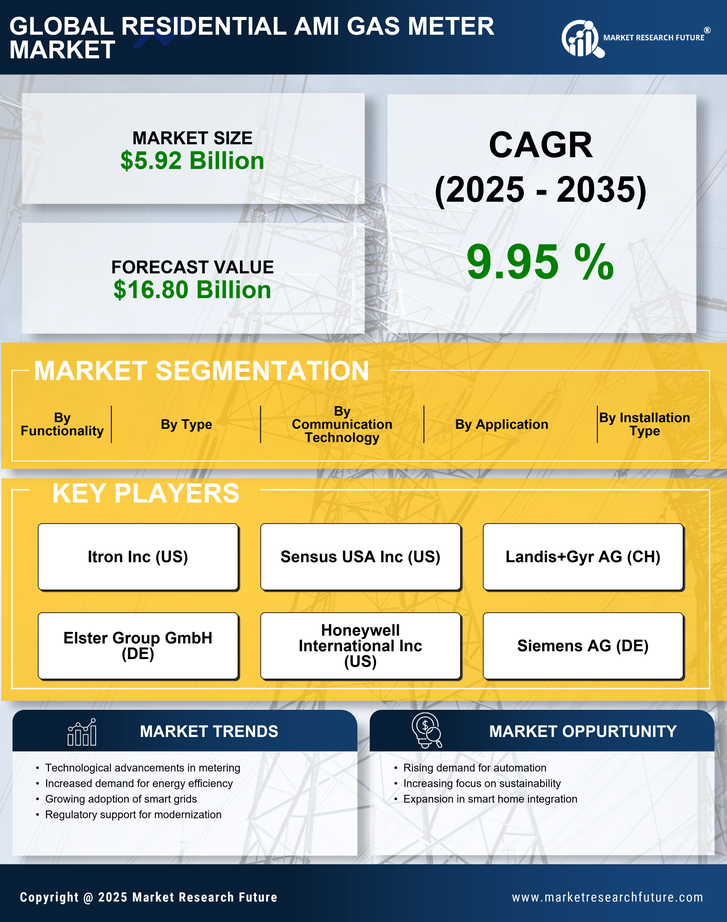

Increased Demand for Energy Efficiency

The Residential AMI Gas Meter Market is experiencing a notable surge in demand for energy-efficient solutions. As consumers become more environmentally conscious, there is a growing inclination towards technologies that promote energy conservation. AMI gas meters facilitate real-time monitoring of gas consumption, enabling households to optimize their usage and reduce waste. According to recent data, the adoption of smart metering technologies has led to a reduction in energy consumption by approximately 15-20% in various regions. This trend is likely to continue, as energy efficiency becomes a priority for both consumers and regulatory bodies, further driving the growth of the Residential AMI Gas Meter Market.

Integration of Smart Home Technologies

The integration of smart home technologies is significantly influencing the Residential AMI Gas Meter Market. As households increasingly adopt smart devices, the demand for compatible gas meters that can seamlessly connect with home automation systems is on the rise. These advanced meters not only provide accurate consumption data but also allow users to control their gas usage remotely. Market analysis indicates that the smart home market is projected to grow at a compound annual growth rate of over 25% in the coming years. This growth is expected to bolster the Residential AMI Gas Meter Market, as consumers seek integrated solutions that enhance convenience and efficiency.