Rising Natural Gas Availability

The availability of natural gas is a crucial driver for the Residential Gas Storage Water Heater Market. With the expansion of natural gas infrastructure and increased production, consumers have greater access to this energy source. This accessibility encourages homeowners to opt for gas storage water heaters, which are often more cost-effective than electric alternatives. Data indicates that natural gas prices have remained relatively stable, making it an attractive option for heating water. Furthermore, as more regions invest in natural gas pipelines, the market for gas storage water heaters is expected to grow. This trend suggests a potential increase in market penetration as consumers recognize the benefits of using natural gas for their heating needs.

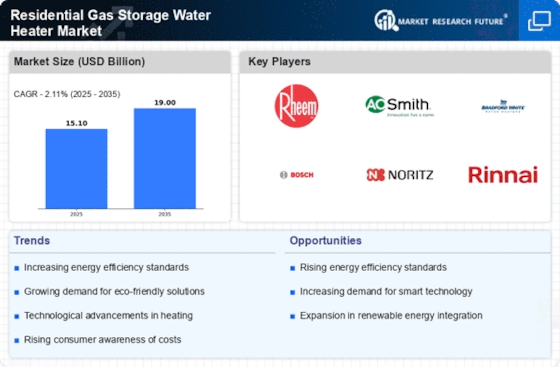

Increasing Demand for Energy Efficiency

The Residential Gas Storage Water Heater Market is experiencing a notable shift towards energy-efficient appliances. Consumers are increasingly aware of energy consumption and its impact on utility bills. This awareness drives demand for gas storage water heaters that offer better efficiency ratings. According to recent data, energy-efficient models can reduce energy consumption by up to 30% compared to older units. As a result, manufacturers are focusing on developing products that meet these efficiency standards, which not only appeal to environmentally conscious consumers but also align with governmental energy-saving initiatives. This trend is likely to continue, as energy efficiency becomes a priority for homeowners looking to reduce their carbon footprint while enjoying reliable hot water supply.

Technological Innovations in Water Heating

Technological advancements play a pivotal role in shaping the Residential Gas Storage Water Heater Market. Innovations such as smart thermostats, improved insulation, and advanced burner technologies enhance the performance and efficiency of gas storage water heaters. These technologies not only provide better temperature control but also contribute to energy savings. For instance, smart water heaters can learn user patterns and adjust heating schedules accordingly, leading to reduced energy consumption. The integration of IoT technology is also becoming more prevalent, allowing homeowners to monitor and control their water heaters remotely. As these innovations continue to emerge, they are likely to attract consumers seeking modern solutions for their hot water needs.

Consumer Preference for Reliable Hot Water Supply

The demand for a consistent and reliable hot water supply is a fundamental driver in the Residential Gas Storage Water Heater Market. Homeowners prioritize appliances that can deliver hot water on demand, especially in regions with colder climates. Gas storage water heaters are known for their ability to provide a steady supply of hot water, making them a preferred choice for many households. Market data suggests that a significant percentage of consumers consider reliability as a key factor when purchasing water heaters. This preference is likely to sustain the market's growth, as manufacturers continue to emphasize the reliability and performance of their gas storage models to meet consumer expectations.

Government Incentives for Energy-Efficient Appliances

Government initiatives aimed at promoting energy efficiency are influencing the Residential Gas Storage Water Heater Market. Various programs offer incentives for homeowners to upgrade to energy-efficient appliances, including gas storage water heaters. These incentives can take the form of tax credits, rebates, or grants, making it financially attractive for consumers to invest in newer, more efficient models. Data indicates that regions with robust incentive programs see higher adoption rates of energy-efficient water heaters. As governments continue to prioritize energy conservation and sustainability, these incentives are expected to play a crucial role in driving market growth, encouraging consumers to transition to gas storage water heaters.