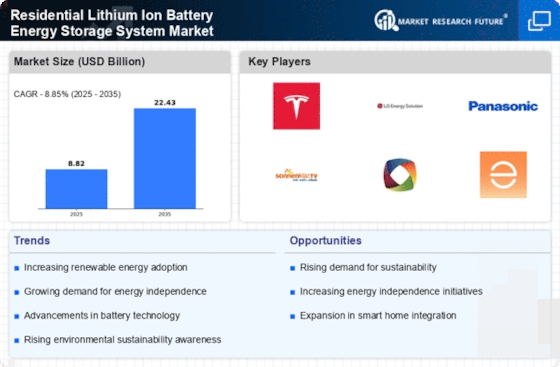

Rising Energy Costs

The escalating costs of traditional energy sources appear to be a primary driver for the Residential Lithium Ion Battery Energy Storage System Market. As energy prices continue to rise, homeowners are increasingly seeking alternative solutions to mitigate their energy expenses. This trend is particularly evident in regions where electricity rates have surged significantly over the past few years. The integration of lithium-ion battery systems allows consumers to store energy during off-peak hours when rates are lower, thereby reducing overall energy costs. Furthermore, the potential for energy independence is becoming more appealing, as homeowners look to decrease reliance on utility companies. This shift towards self-sufficiency is likely to bolster the demand for residential energy storage solutions, indicating a robust growth trajectory for the market.

Technological Innovations

Technological advancements in battery technology are significantly influencing the Residential Lithium Ion Battery Energy Storage System Market. Innovations such as improved energy density, longer life cycles, and enhanced safety features are making lithium-ion batteries more appealing to consumers. Recent developments have led to batteries that can store more energy in a smaller footprint, which is particularly advantageous for residential applications. Additionally, advancements in smart technology integration allow homeowners to monitor and manage their energy usage more effectively. This capability not only enhances user experience but also optimizes energy consumption patterns. As technology continues to evolve, it is expected that the efficiency and affordability of residential energy storage systems will improve, thereby attracting more consumers to the market.

Government Support and Incentives

Government policies and incentives play a crucial role in shaping the Residential Lithium Ion Battery Energy Storage System Market. Many governments are implementing programs aimed at promoting renewable energy adoption and energy storage solutions. These initiatives often include tax credits, rebates, and grants for homeowners who invest in energy storage systems. Such financial incentives can significantly lower the upfront costs associated with purchasing and installing lithium-ion batteries, making them more accessible to a broader audience. Data suggests that regions with robust government support have seen a marked increase in residential energy storage installations. As these policies evolve and expand, they are likely to further stimulate market growth, encouraging more homeowners to consider energy storage as a viable option.

Increased Demand for Energy Independence

The desire for energy independence is becoming a prominent driver in the Residential Lithium Ion Battery Energy Storage System Market. Homeowners are increasingly motivated to reduce their dependence on traditional energy providers, particularly in areas prone to power outages or fluctuating energy prices. The ability to store energy generated from renewable sources empowers consumers to take control of their energy usage. This trend is reflected in the rising number of installations of residential energy storage systems, as individuals seek to create self-sufficient energy solutions. Moreover, the potential for energy resilience during emergencies or natural disasters adds an additional layer of appeal. As awareness of these benefits grows, the market for residential lithium-ion battery systems is expected to expand, catering to the needs of consumers seeking autonomy in their energy consumption.

Environmental Concerns and Sustainability

Growing awareness of environmental issues and the need for sustainable energy solutions are driving the Residential Lithium Ion Battery Energy Storage System Market. Consumers are increasingly concerned about their carbon footprints and are actively seeking ways to reduce their environmental impact. The adoption of lithium-ion battery systems aligns with these values, as they facilitate the use of renewable energy sources such as solar and wind. By storing excess energy generated from these sources, homeowners can utilize clean energy even when production is low. This trend is supported by data indicating that residential energy storage installations have increased significantly, reflecting a shift towards more sustainable living practices. As environmental regulations become more stringent, the demand for energy storage solutions that support renewable integration is likely to grow, further propelling the market.