Respiratory Device Accessories Devices Market Summary

As per Market Research Future analysis, the Respiratory Device Accessories Market was estimated at 0.8562 USD Billion in 2024. The respiratory device accessories industry is projected to grow from 0.9164 USD Billion in 2025 to 1.808 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.03% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Respiratory Device Accessories Devices Market is poised for substantial growth driven by technological advancements and increasing health awareness.

- Technological advancements are enhancing the functionality and efficiency of respiratory device accessories.

- The focus on patient comfort is becoming increasingly paramount, influencing product design and development.

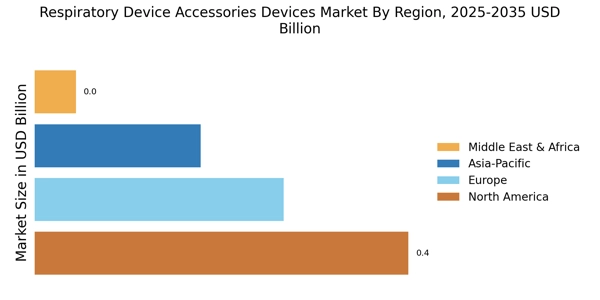

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in this sector.

- Key market drivers include the increasing prevalence of respiratory diseases and technological innovations in device accessories.

Market Size & Forecast

| 2024 Market Size | 0.8562 (USD Billion) |

| 2035 Market Size | 1.808 (USD Billion) |

| CAGR (2025 - 2035) | 7.03% |

Major Players

Philips (NL), ResMed (AU), Medtronic (US), Breathe Technologies (US), Fisher & Paykel Healthcare (NZ), Apex Medical (TW), Drive DeVilbiss Healthcare (GB), Invacare (US)