Growing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases is a key driver for the Respiratory Infectious Disease Diagnostics Market. Conditions such as pneumonia, bronchitis, and influenza are becoming increasingly common, leading to a heightened need for effective diagnostic solutions. According to recent estimates, respiratory infections account for a significant percentage of global morbidity and mortality rates. This alarming trend is prompting healthcare systems to invest more in diagnostic capabilities to ensure timely and accurate detection of infectious agents. As the burden of respiratory diseases continues to escalate, the market for diagnostic tools is expected to expand, with a focus on developing more sensitive and specific tests. This growing prevalence is likely to stimulate innovation and investment within the Respiratory Infectious Disease Diagnostics Market.

Increased Government Initiatives and Funding

Government initiatives aimed at combating respiratory infections are playing a pivotal role in shaping the Respiratory Infectious Disease Diagnostics Market. Various health authorities are allocating substantial funding to enhance diagnostic infrastructure and promote research and development in this field. For instance, initiatives that focus on improving access to diagnostic testing in underserved areas are gaining traction. This is particularly important in low-resource settings where the burden of respiratory diseases is often highest. The financial support from governments is likely to encourage the development of novel diagnostic technologies and expand the availability of existing tests. As a result, the Respiratory Infectious Disease Diagnostics Market is expected to benefit from these initiatives, leading to improved health outcomes and increased market growth.

Technological Innovations in Diagnostic Tools

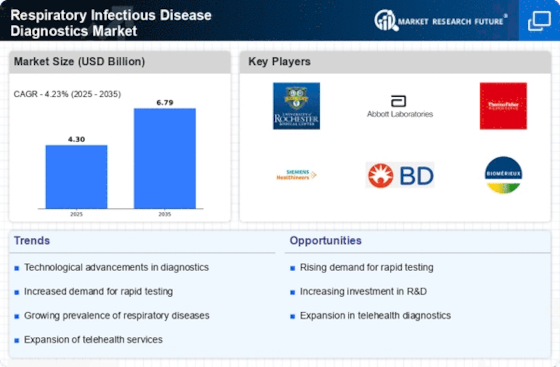

The Respiratory Infectious Disease Diagnostics Market is experiencing a surge in technological innovations that enhance diagnostic accuracy and speed. Advanced molecular techniques, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), are becoming increasingly prevalent. These technologies allow for rapid identification of pathogens, which is crucial in managing respiratory infections. The market is projected to grow at a compound annual growth rate (CAGR) of approximately 8% over the next five years, driven by these advancements. Furthermore, the integration of artificial intelligence in diagnostic tools is expected to streamline workflows and improve patient outcomes. As healthcare providers seek more efficient solutions, the demand for these innovative diagnostic tools is likely to rise, thereby propelling the Respiratory Infectious Disease Diagnostics Market forward.

Emergence of Telemedicine and Remote Diagnostics

The emergence of telemedicine is transforming the landscape of the Respiratory Infectious Disease Diagnostics Market. With the increasing adoption of remote healthcare services, patients are now able to access diagnostic testing from the comfort of their homes. This shift is particularly beneficial for individuals with respiratory conditions, as it allows for timely diagnosis and management without the need for in-person visits. The convenience and accessibility of telemedicine are likely to drive demand for at-home diagnostic kits and remote monitoring solutions. As healthcare systems adapt to this new paradigm, the market for respiratory diagnostics is expected to expand, with a focus on developing user-friendly and reliable testing options. The integration of telemedicine into the Respiratory Infectious Disease Diagnostics Market may lead to improved patient engagement and adherence to treatment protocols.

Rising Awareness and Education on Respiratory Health

There is a growing awareness regarding respiratory health, which is significantly influencing the Respiratory Infectious Disease Diagnostics Market. Public health campaigns aimed at educating populations about the symptoms and risks associated with respiratory infections are becoming more prevalent. This increased awareness is likely to lead to higher rates of testing and diagnosis, as individuals become more proactive in seeking medical attention. Additionally, healthcare professionals are receiving enhanced training on the importance of early detection and management of respiratory diseases. As awareness continues to rise, the demand for diagnostic tools is expected to increase, thereby driving growth in the Respiratory Infectious Disease Diagnostics Market. This trend underscores the importance of education in improving health outcomes and reducing the burden of respiratory infections.