Cost Reduction Strategies

In the Retail Self Checkout Terminals Market, cost reduction strategies are becoming a primary driver for adoption. Retailers are increasingly recognizing the potential for self-checkout systems to lower operational costs by minimizing the need for staff at checkout points. Data suggests that implementing self-checkout terminals can reduce labor costs by up to 20%, allowing retailers to allocate resources more efficiently. This financial incentive is compelling many businesses to transition towards self-service solutions. As retailers strive to enhance profitability while maintaining customer satisfaction, the demand for self-checkout terminals is likely to rise, further solidifying their role in modern retail environments.

Technological Advancements

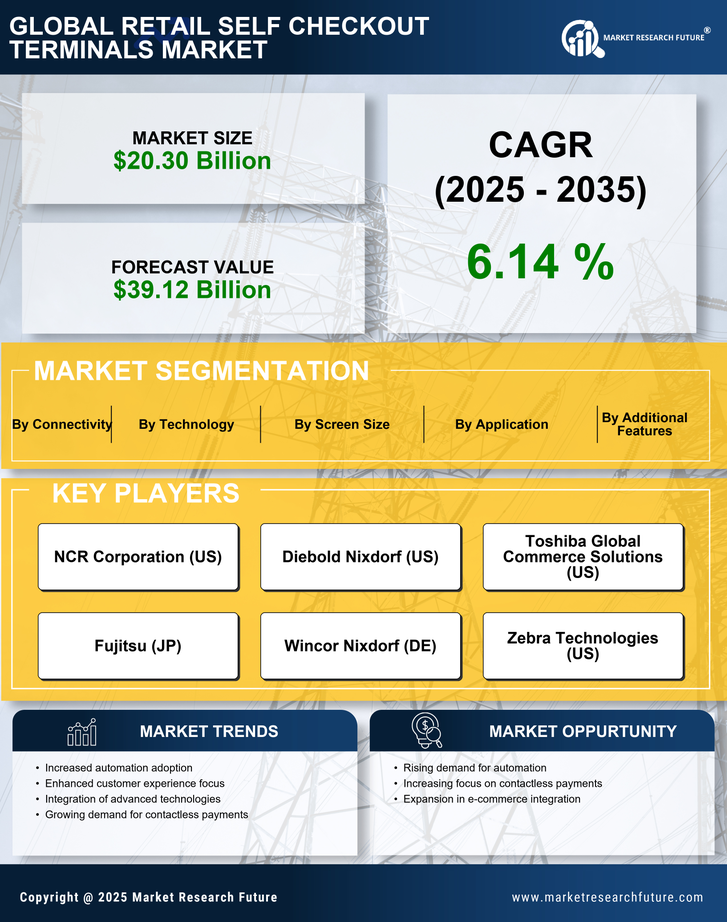

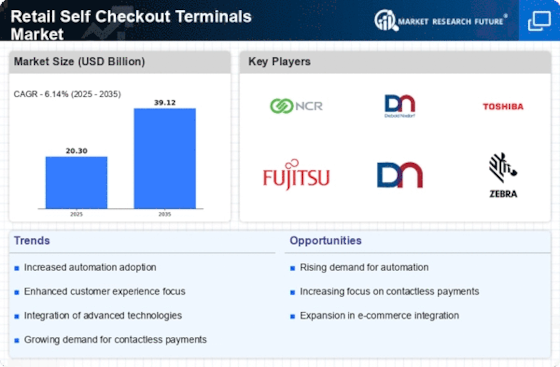

The Retail Self Checkout Terminals Market is experiencing a surge in technological advancements that enhance operational efficiency. Innovations such as artificial intelligence and machine learning are being integrated into self-checkout systems, allowing for improved customer interaction and error reduction. These technologies facilitate faster transaction processing, which is crucial in high-traffic retail environments. According to recent data, the adoption of advanced self-checkout systems has increased by approximately 30% over the past two years, indicating a strong trend towards automation in retail. As retailers seek to streamline operations and reduce labor costs, the demand for technologically advanced self-checkout terminals is likely to continue growing, positioning this market for substantial expansion.

Enhanced Customer Experience

The Retail Self Checkout Terminals Market is also driven by the need for enhanced customer experiences. Retailers are focusing on creating seamless and efficient shopping environments, and self-checkout systems play a crucial role in this strategy. By reducing wait times and providing a user-friendly interface, these terminals contribute to a more satisfying shopping experience. Recent studies indicate that retailers implementing self-checkout solutions have reported a 25% increase in customer satisfaction scores. As businesses recognize the importance of customer experience in driving loyalty and repeat business, the adoption of self-checkout terminals is expected to grow, reflecting a broader trend towards customer-centric retail strategies.

Consumer Preference for Self-Service

The Retail Self Checkout Terminals Market is significantly influenced by changing consumer preferences towards self-service options. Shoppers increasingly favor the autonomy and speed that self-checkout systems provide, allowing them to complete transactions at their own pace. This shift in consumer behavior is reflected in a survey indicating that over 60% of consumers prefer self-checkout to traditional cashier services. Retailers are responding to this demand by investing in self-checkout solutions that enhance the shopping experience. As more consumers embrace self-service technologies, the market for retail self-checkout terminals is poised for growth, driven by the need to meet evolving customer expectations.

Integration with Mobile Payment Solutions

The Retail Self Checkout Terminals Market is witnessing a growing trend towards the integration of mobile payment solutions. As consumers increasingly utilize smartphones for transactions, retailers are adapting by incorporating mobile payment options into self-checkout systems. This integration not only caters to consumer preferences but also enhances transaction speed and security. Data shows that mobile payment usage has risen by over 40% in retail settings, prompting retailers to invest in self-checkout terminals that support these technologies. As the demand for convenient and secure payment methods continues to rise, the market for retail self-checkout terminals is likely to expand, driven by the need to accommodate evolving payment preferences.