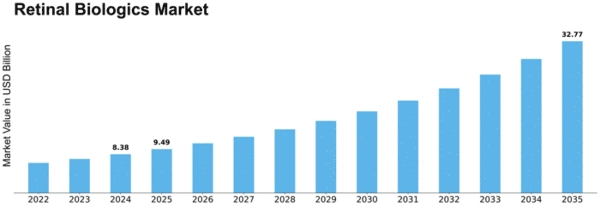

Retinal Biologics Size

Retinal Biologics Market Growth Projections and Opportunities

The Pharmaceutical Retinal Biologics Market is an ever-changing sector in the pharmaceutical industry that addresses retinal concerns, a key component of the eye for processing visual information. It comprises biological drugs developed for retinal diseases like diabetic retinopathy, age-related macular degeneration (AMD), and retinal vein occlusion. The medications are different from normal drugs or other ophthalmic preparations because they are made from living organisms and also designed to stop specific proteins causing ailments of the eye.

One of its key drivers has been increased cases involving retinal diseases particularly among old people. Among people aged 50 years and more, advanced macular degeneration accounts for greater loss of sight than any other cause. Anti-angiogenesis methods may offer newer treatment options compared to traditional ones by blocking certain molecules involved in pathogenesis of retinal diseases.

Anti-vascular endothelial growth factor (anti-VEGF) biologics is one class within The Pharmaceutical Retina Biologics Market group with huge implications. They include aflibercept, ranibizumab and bevacizumab that prevent abnormal blood vessels growth on retina shown in many types of retinal diseases. These biologics function through inhibiting VEGF thereby reducing vascular leakage, neovascularization inhibition and slow progression of disease. Like AMD, Anti-VEGF therapy completely altered treatment paradigms for many conditions.

Besides, there is concern about individuals living with this condition over long period who frequently require ongoing dosing or treatment. There are also sustained-release systems based on brolucizumab which provide continuous therapeutic effects thus decreasing number of injections needed to manage the condition. It therefore simplifies access to these therapies leading to better long-term outcomes as patients have improved medication adherence.

Some issues encountered by The Pharmaceutical Retinal Biologics Market encompass necessity for further research and development activities targeting new mechanisms or targets related to retinal disorders. Despite great success of anti-VEGF biologics, other pathways and novel biologics that can address other aspects of retinal diseases such as neuroprotection, inflammation is still being investigated. Thus, market response involves dynamic collaborations between drug manufacturers, academia, and doctors who want to know more about retinal biology and find new therapeutic goals.

Therefore, the focus in the emerging Pharmaceutical Retinal Biologics Market is personalized medicine approaches whereby treatments are based on specific disease profiles or traits/attributes exhibited by each patient. This would involve searching for biomarkers or genetic factors that make a distinction as far as individual responses to certain retinal biologics are concerned leading to better therapy planning. Personalization of medication optimizes the therapeutic outcomes while minimizing adverse effects hence contributing towards overall successfulness of retinal biological treatments.

Leave a Comment