Consumer Expectations

Consumer expectations are evolving, significantly impacting the Reverse Logistic Market. Today's consumers demand hassle-free return processes and quick refunds, which compel retailers to enhance their reverse logistics capabilities. A survey indicates that 67% of consumers consider a retailer's return policy before making a purchase, underscoring the importance of efficient reverse logistics. As e-commerce continues to expand, the volume of returns is expected to rise, necessitating robust reverse logistics solutions. Companies that can meet these consumer expectations are likely to gain a competitive edge, driving growth in the Reverse Logistic Market. This trend suggests that businesses must invest in improving their return processes to satisfy customer demands.

Regulatory Compliance

Regulatory compliance is an essential driver for the Reverse Logistic Market. Governments worldwide are implementing stricter regulations regarding waste management, product returns, and recycling. Companies are required to adhere to these regulations to avoid penalties and maintain their market position. For example, the European Union's Waste Electrical and Electronic Equipment Directive mandates proper disposal and recycling of electronic products, which directly influences reverse logistics operations. As compliance becomes increasingly complex, businesses are compelled to invest in efficient reverse logistics systems to ensure adherence. This trend indicates that the Reverse Logistic Market will likely see growth as companies seek to navigate regulatory landscapes effectively.

Cost Reduction Strategies

Cost reduction strategies are a fundamental driver for the Reverse Logistic Market. Companies are increasingly recognizing that efficient reverse logistics can lead to significant savings. By optimizing return processes and minimizing waste, businesses can reduce operational costs associated with returns. Data suggests that effective reverse logistics can lower costs by up to 20%, making it a critical focus for many organizations. As competition intensifies, companies are compelled to streamline their reverse logistics operations to enhance profitability. This trend indicates that the Reverse Logistic Market will continue to expand as businesses seek innovative ways to reduce costs while improving service levels.

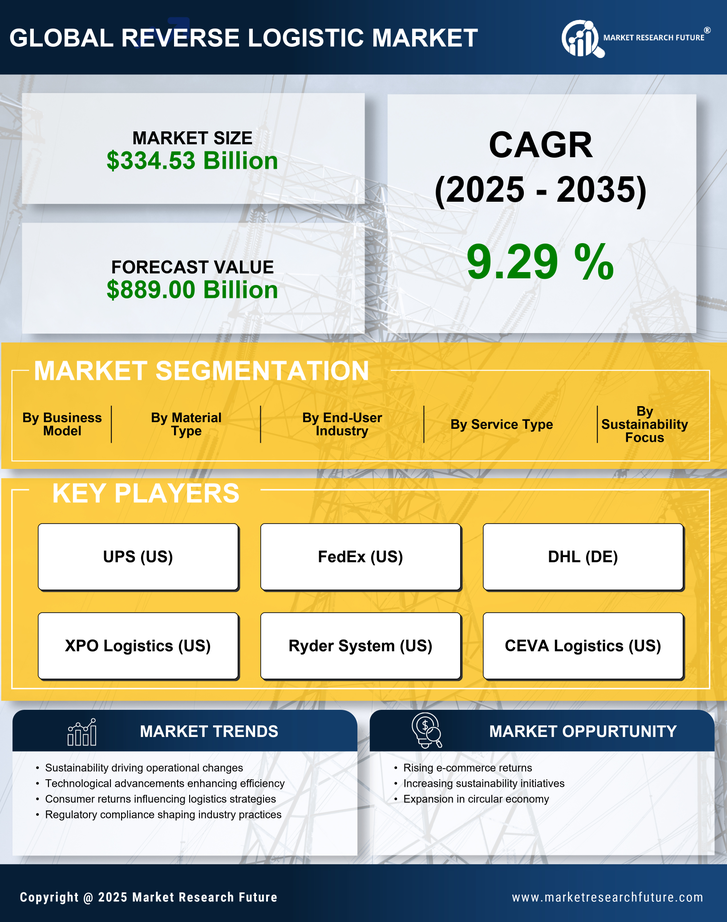

Sustainability Initiatives

The increasing emphasis on sustainability initiatives is a pivotal driver for the Reverse Logistic Market. Companies are increasingly adopting eco-friendly practices, which necessitate efficient reverse logistics to manage returns and recycling processes. According to recent data, the market for sustainable packaging is projected to reach USD 500 billion by 2027, indicating a growing trend towards environmentally responsible practices. This shift not only enhances brand reputation but also aligns with consumer preferences for sustainable products. As businesses strive to minimize their carbon footprint, the Reverse Logistic Market is likely to experience heightened demand for services that facilitate the return and recycling of products, thereby contributing to a circular economy.

Technological Advancements

Technological advancements play a crucial role in shaping the Reverse Logistic Market. Innovations such as artificial intelligence, machine learning, and blockchain are transforming how companies manage returns and inventory. For instance, AI-driven analytics can optimize return processes, reducing costs and improving efficiency. The integration of blockchain technology enhances transparency and traceability in the reverse supply chain, which is increasingly important for compliance and consumer trust. As per industry estimates, the adoption of advanced technologies in logistics could lead to a 30% reduction in operational costs. Consequently, the Reverse Logistic Market is poised for growth as businesses leverage these technologies to streamline their reverse logistics operations.