Rf Filters Size

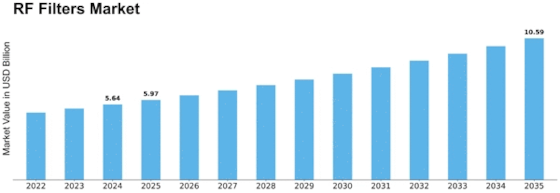

RF Filters Market Growth Projections and Opportunities

This comprehensive study delves into the global RF filter market, providing in-depth insights into industry trends, market dynamics, size, competitive landscape, and growth prospects. The research report classifies the global RF filter market based on component, application, end-use, and region/country.

Regarding filter types, the RF filter market is categorized into two segments: Surface Acoustic Wave (SAW) and Bulk Acoustic Wave (BAW). The SAW segment held a dominant position in 2020 and is anticipated to maintain this position throughout the review period. Conversely, the BAW segment is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) from 2021 to 2027.

The connectivity technology segment of the RF filter market comprises cellular, Wi-Fi, Bluetooth, and other technologies. Within the cellular segment, the breakdown includes 2G/3G and 4G/5G, with the 4G/5G sub-segment projected to witness the highest CAGR of 18.5%.

Functional types within the RF filter market include cellular devices, GPS devices, radio broadcast, TV broadcast, and others. The cellular devices segment is expected to dominate the global market between 2021 and 2027.

Application-wise, the RF filter market encompasses consumer electronics, industrial applications, automotive, transportation and logistics, smart home/city, aerospace & defense, and other sectors.

The study encompasses regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Among these, Asia-Pacific is forecasted to lead the RF filter market during the study period.

The global RF filter market is highly competitive, boasting numerous vendors offering innovative solutions. Major vendors profiled in the study include YAGEO Group, RTx Technology Co., Ltd, Bird, Crystek Corporation, Akoustis, Skyworks Solution Inc., MURATA Manufacturing Co Ltd, Qorvo, Broadcom, TDK Corporation, Avnet Inc, Tai-SAW Technology Co. Ltd, and Abracon. These companies strive to provide feature-rich solutions to their customers, intensifying the market competition.

This research delves into the worldwide RF filter market, presenting comprehensive insights into its trends, dynamics, market size, competitive scenario, and growth prospects. The report segments the global RF filter market based on various factors such as component, application, end use, and region/country.

The market has been classified into two main types of RF filters: SAW (Surface Acoustic Wave) and BAW (Bulk Acoustic Wave). In 2020, the SAW segment held the largest market share and is expected to maintain its dominance in the coming years. On the other hand, the BAW segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period from 2021 to 2027.

Regarding connectivity technology, the RF filter market is divided into cellular, Wi-Fi, Bluetooth, and others. Within the cellular segment, sub-categories include 2G/3G and 4G/5G, with the latter expected to demonstrate the highest CAGR of 18.5%.

Functional types in the RF filter market include cellular devices, GPS devices, radio broadcast, TV broadcast, and others. Among these, the cellular devices segment is foreseen to command the global market from 2021 to 2027.

Applications of RF filters span across various sectors such as consumer electronics, industrial, automotive, transportation, logistics, smart home/city, aerospace & defense, and others.

This study encompasses several regions including North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Asia-Pacific is anticipated to be the dominant region in the RF filter market throughout the study period.

In this highly competitive global market, numerous vendors are vying for market share by offering innovative and feature-rich solutions. Key players highlighted in the study include YAGEO Group, RTx Technology Co., Ltd, Bird, Crystek Corporation, Akoustis, Skyworks Solution Inc., MURATA Manufacturing Co Ltd, Qorvo, Broadcom, TDK Corporation, Avnet Inc, Tai-SAW Technology Co. Ltd, and Abracon. These companies are known for their advanced offerings and strive to cater to the evolving needs of their customers.

Leave a Comment