Increased Demand for Automation

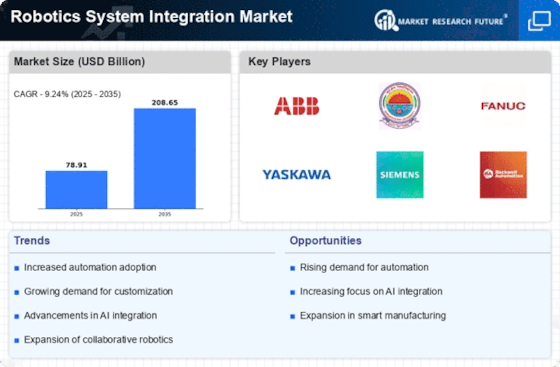

The Robotics System Integration Market is experiencing a surge in demand for automation across various sectors. Industries such as manufacturing, logistics, and healthcare are increasingly adopting robotic systems to enhance efficiency and reduce operational costs. According to recent data, the automation market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This trend indicates a strong inclination towards integrating robotic systems, as companies seek to streamline processes and improve productivity. The Robotics System Integration Market is thus positioned to benefit from this growing demand, as businesses recognize the potential of robotics to transform their operations and maintain competitive advantages.

Advancements in Robotics Technology

Technological advancements are playing a pivotal role in shaping the Robotics System Integration Market. Innovations in sensors, machine learning, and artificial intelligence are enabling the development of more sophisticated robotic systems. These advancements allow for improved precision, adaptability, and functionality, which are essential for various applications. For instance, the integration of AI in robotics has led to enhanced decision-making capabilities, making robots more autonomous and efficient. As technology continues to evolve, the Robotics System Integration Market is likely to witness an influx of new solutions that cater to diverse industry needs, thereby driving market growth.

Growing Focus on Safety and Compliance

Safety and compliance regulations are becoming increasingly stringent across industries, which is influencing the Robotics System Integration Market. Companies are compelled to adopt robotic systems that not only enhance productivity but also adhere to safety standards. The integration of robotics can significantly reduce workplace accidents and improve overall safety. For example, in manufacturing environments, robots can take over hazardous tasks, thereby minimizing human exposure to risks. This focus on safety is likely to propel the demand for robotics integration solutions, as organizations strive to create safer work environments while maintaining operational efficiency.

Rising Labor Costs and Skills Shortages

The Robotics System Integration Market is being driven by rising labor costs and a shortage of skilled labor in various sectors. As wages continue to increase, companies are seeking cost-effective solutions to maintain profitability. Robotics offers a viable alternative, allowing businesses to automate repetitive tasks and reduce reliance on human labor. Furthermore, the skills gap in the workforce is prompting organizations to invest in robotic systems that can operate with minimal human intervention. This trend is expected to accelerate the adoption of robotics, as companies look to integrate these systems to address labor challenges and enhance productivity.

Expansion of E-commerce and Supply Chain Automation

The expansion of e-commerce is significantly impacting the Robotics System Integration Market. As online shopping continues to grow, there is an increasing need for efficient supply chain operations. Robotics integration in warehousing and logistics is becoming essential to meet the demands of rapid order fulfillment and inventory management. Data indicates that the e-commerce sector is projected to grow by over 15% annually, driving the need for automated solutions. Consequently, the Robotics System Integration Market is likely to see substantial growth as businesses invest in robotic systems to optimize their supply chains and enhance customer satisfaction.

.png)