North America : Defense Innovation Leader

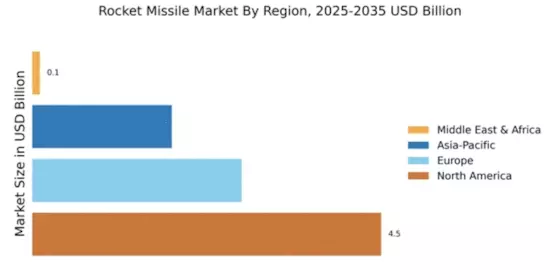

North America continues to lead the rocket missile market, holding a significant share of 4.55 in 2024. The region's growth is driven by increased defense budgets, technological advancements, and a focus on modernization of military capabilities. Regulatory support from government initiatives further catalyzes demand, ensuring that North America remains at the forefront of missile technology development.

The competitive landscape is characterized by major players such as Lockheed Martin, Northrop Grumman, and Raytheon Technologies, which dominate the market. These companies are heavily invested in R&D, leading to innovative solutions that meet evolving defense needs. The U.S. government’s commitment to enhancing national security through advanced missile systems solidifies the region's position as a global leader in the rocket missile sector.

Europe : Strategic Defense Collaborations

Europe's rocket missile market is projected to grow, with a market size of 2.73 in 2024. The region benefits from strategic collaborations among NATO countries, which enhance defense capabilities and foster innovation. Regulatory frameworks are increasingly supportive, promoting joint ventures and technology sharing, which are crucial for meeting the rising defense demands in Europe.

Leading countries such as the UK, France, and Germany are at the forefront of this market, with key players like BAE Systems and Thales Group driving advancements. The competitive landscape is marked by a focus on developing next-generation missile systems, ensuring that European nations can effectively respond to emerging threats. The emphasis on collaborative defense initiatives further strengthens the region's market position.

Asia-Pacific : Emerging Defense Market

The Asia-Pacific region is witnessing rapid growth in the rocket missile market, with a size of 1.82 in 2024. This growth is fueled by increasing military expenditures, regional tensions, and a focus on indigenous defense production. Countries are investing heavily in modernizing their armed forces, which is driving demand for advanced missile systems and technologies.

Key players in this region include Hanwha Defense and Kongsberg Gruppen, which are expanding their presence through partnerships and local manufacturing. Nations like India, South Korea, and Japan are leading the charge in missile development, focusing on enhancing their defense capabilities. The competitive landscape is evolving, with a strong emphasis on innovation and technological advancements to meet the unique security needs of the region.

Middle East and Africa : Emerging Defense Sector

The Middle East and Africa region represents a nascent market for rocket missiles, with a size of 0.1 in 2024. Despite its smaller market share, there is significant potential for growth driven by geopolitical tensions and increasing defense budgets. Countries in this region are recognizing the need to enhance their military capabilities, leading to a gradual rise in demand for missile systems.

Key players are beginning to establish a foothold in this market, with local defense companies exploring partnerships with global firms. Nations such as the UAE and Saudi Arabia are investing in advanced military technologies, aiming to bolster their defense strategies. The competitive landscape is still developing, but the focus on modernization presents opportunities for growth in the rocket missile sector.