Market Analysis

In-depth Analysis of Rolling Stock Cables Market Industry Landscape

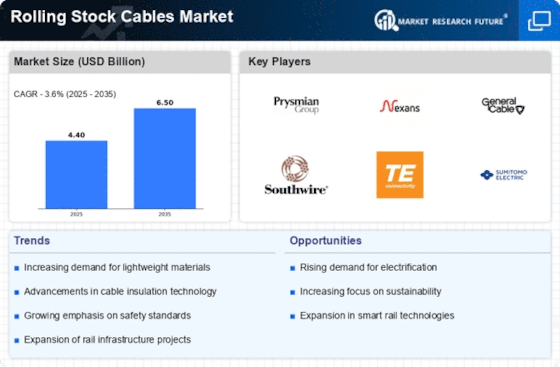

The Rolling Stock Cables Market is characterized by dynamic and multifaceted market dynamics that shape its trajectory. One of the key driving forces is the rapid technological advancements in the field. As the rail industry embraces innovation, there is a growing demand for rolling stock cables that incorporate cutting-edge materials and manufacturing techniques. These technological upgrades enhance the overall performance, efficiency, and safety of rolling stock cables, reflecting the industry's commitment to staying at the forefront of technological progress.

Regulatory factors also significantly influence the market dynamics of rolling stock cables. Governments and regulatory bodies impose stringent standards and guidelines to ensure the safety and reliability of rail transportation. Compliance with these regulations is not only a legal necessity but also a critical aspect of market acceptance. Manufacturers must navigate and adapt to evolving regulatory landscapes to meet safety requirements and gain the trust of customers and industry stakeholders.

The global economy plays a crucial role in shaping the market dynamics of rolling stock cables. Economic fluctuations, currency exchange rates, and overall economic stability impact the cost of raw materials and manufacturing processes. As a result, these economic factors influence the pricing of rolling stock cables and can affect the purchasing decisions of manufacturers and end-users. The industry must remain resilient in the face of economic challenges and adapt strategies to navigate the dynamic economic environment.

The expansion and development of railway infrastructure globally contribute significantly to the market dynamics of rolling stock cables. Investments in rail projects, such as the construction of new rail networks and the upgrade of existing ones, drive the demand for high-quality cables. The ongoing urbanization and population growth in various regions further fuel the need for efficient and reliable transportation systems, thereby stimulating the market for rolling stock cables.

Market dynamics are also shaped by environmental considerations and sustainability goals. With increasing awareness of environmental issues, there is a growing preference for rolling stock cables that are energy-efficient and environmentally friendly. Manufacturers are under pressure to develop cables that align with sustainable practices, contributing to the overall green initiatives of the rail industry. This shift towards sustainability reflects changing consumer preferences and influences the market dynamics of rolling stock cables.

Competition among industry players is another critical factor influencing market dynamics. The presence of key players and the level of competition drive product innovation, pricing strategies, and overall market trends. Established companies invest in research and development to maintain a competitive edge, leading to the introduction of advanced rolling stock cable solutions. The competitive landscape fosters continuous improvement and innovation, benefiting end-users with more reliable and efficient products.

Leave a Comment