Market Trends

Key Emerging Trends in the Rolling Stock Cables Market

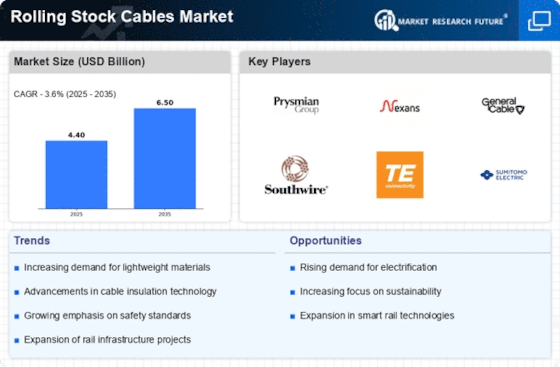

The Rolling Stock Cables Market is witnessing several notable market trends that reflect the evolving landscape of the rail industry. One prominent trend is the increasing emphasis on electrification in railway systems. As countries strive to reduce carbon emissions and embrace sustainable practices, there is a growing shift towards electrified rail networks. This transition drives the demand for specialized rolling stock cables designed for high-performance electrical applications, presenting an opportunity for manufacturers to cater to the evolving needs of electrified rail infrastructure.

Another significant trend is the integration of smart technologies in rolling stock cables. The advent of the Internet of Things (IoT) and data-driven solutions has paved the way for smart and connected rail systems. Rolling stock cables embedded with sensors and communication technologies enable real-time monitoring of cable health, performance, and maintenance needs. This trend not only enhances operational efficiency but also contributes to the development of predictive maintenance strategies, reducing downtime and improving overall system reliability.

The market is also witnessing a growing demand for lightweight and high-strength materials in rolling stock cables. Weight reduction is a critical consideration for rail operators seeking to improve energy efficiency and reduce operational costs. Manufacturers are responding to this trend by developing cables that incorporate advanced materials, offering a balance between strength and weight. This approach aligns with the broader industry goal of optimizing the efficiency of rolling stock without compromising on safety and performance.

Environmental sustainability is a key driver influencing market trends in the Rolling Stock Cables Market. The industry is experiencing a surge in demand for eco-friendly and recyclable materials in cable manufacturing. As environmental regulations become more stringent, manufacturers are investing in research and development to create rolling stock cables with reduced environmental impact. This trend reflects a broader commitment to sustainable practices within the rail sector and aligns with the global push towards greener transportation solutions.

An emerging trend in the market is the focus on fire-resistant and flame-retardant rolling stock cables. Safety is a paramount concern in the rail industry, and the demand for cables that can withstand fire incidents and maintain functionality during emergencies is on the rise. Manufacturers are responding by developing cables with enhanced fire-resistant properties, meeting stringent safety standards and ensuring the reliability of rolling stock systems in various operational scenarios.

The implementation of stringent safety standards and regulations is influencing market trends in terms of product certifications. End-users increasingly prioritize rolling stock cables that comply with industry-specific safety standards and certifications. Manufacturers are investing in obtaining relevant certifications to demonstrate the safety and reliability of their products, thereby gaining a competitive edge in the market and building trust with customers.

Market trends also indicate a growing interest in customized and application-specific rolling stock cables. Different rail applications, such as high-speed trains, metro systems, and freight transportation, have unique requirements for cables in terms of performance, durability, and safety features. Manufacturers are tailoring their products to meet these specific needs, offering customized solutions that cater to the diverse applications within the rolling stock sector.

Leave a Comment