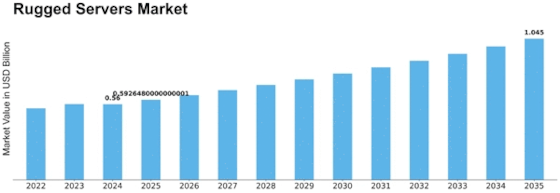

Rugged Servers Size

Rugged Servers Market Growth Projections and Opportunities

There are a lot of important things that help the Rugged Servers Market grow and change. One big reason for this is that more and more places that are hard to reach and risky need reliable computer systems. The military, aircraft, energy, and industrial robots are all fields that work in rough conditions where regular computers might not work. Rugged servers can handle these needs because they are built to handle heavy loads, loud noises, and shocks. This is why they are used a lot in areas where dependability and life are important.

The market for mobile computers is also being changed by the rise in popularity of edge computing. Businesses and groups need ruggedized computers because they want to be able to handle data closer to where it comes from, especially in tough or rural areas. Edge computers that are both powerful and tough make it possible to handle data efficiently. This lets people make decisions faster and with less delay. More and more areas are using edge computing, which is good for the growth of the mobile computers market.

People are becoming more aware of the risks of hacking, which is another big change in the market. Tough computers have extra safety features to keep private data safe in places where it's very important, like defense and key infrastructure. When data protection and safety are very important, rugged servers are the best choice because they can work in safe, separate places.

A bigger part of the market growth is people who want to use the Internet of Things (IoT) in difficult environments. Agricultural, mining, and transportation are some of the fields that use IoT devices to learn new things and get more out of their work. For IoT setups to work in these harsh settings, rugged servers are essential. These servers give you the computing power and connections you need to share and analyze data easily.

The ongoing work to bring the defense business up to date has an impact on the tough computer market as well. Things that the military does are often dangerous and unclear, so the tools they use need to be strong and reliable. Rugged computers that are made to meet strict military standards (MIL-STD) can be useful for defense tasks like command and control, tracking, and communication systems. Armed forces will need tough computers for as long as money for defense includes money for new technologies.

Industry 4.0 is changing, and smart production methods are becoming more common. This is also making the market grow. It is very important to have rugged computers in factories, especially ones with a lot of big tools and production processes. They allow things like robotics, control systems, and data analysis to work. Rugged computers that can work in rough industrial settings are becoming more and more important as more businesses go digital and connect to the internet.

It's also the competition and new developments in tough computer technology that change how the market works. There is always a push to make tough computers faster, more reliable, and smaller by IT companies. Because of changes like better heat control, smaller shapes, and the addition of more advanced features, the market is more competitive now. Companies that make rugged servers work together with other companies in the same field to make strategic deals and connections that help drive innovation and find new uses for ruggedized computing solutions.

Leave a Comment