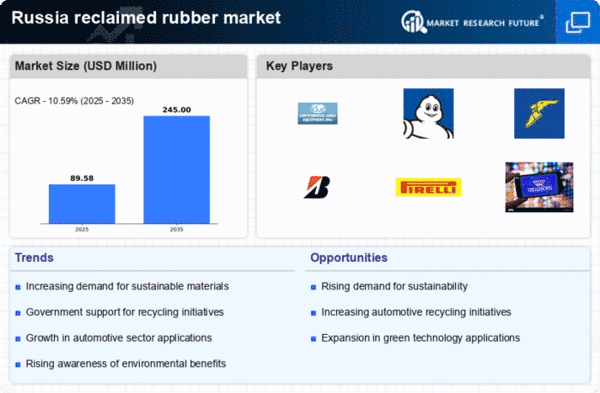

The reclaimed rubber market in Russia is characterized by a competitive landscape that is increasingly shaped by sustainability initiatives and technological advancements. Key players such as Continental AG (Germany), Michelin (France), and Goodyear Tire & Rubber Company (US) are actively pursuing strategies that emphasize innovation and environmental responsibility. These companies are not only focusing on enhancing their product offerings but are also investing in research and development to improve the quality and performance of reclaimed rubber. This collective emphasis on sustainability and innovation appears to be a significant driver of growth within the market, fostering a competitive environment that encourages continuous improvement and adaptation.In terms of business tactics, companies are increasingly localizing manufacturing to reduce costs and enhance supply chain efficiency. This approach is particularly relevant in the context of the reclaimed rubber market, where sourcing raw materials and managing logistics can be complex. The market structure is moderately fragmented, with several key players exerting influence over pricing and product availability. The presence of both multinational corporations and local manufacturers creates a dynamic competitive atmosphere, where collaboration and competition coexist.

In October Michelin (France) announced a partnership with a leading Russian recycling firm to enhance its reclaimed rubber production capabilities. This strategic move is expected to bolster Michelin's supply chain resilience while aligning with its sustainability goals. By leveraging local expertise, Michelin aims to optimize its operations and reduce its carbon footprint, which could potentially set a new standard for environmental practices in the industry.

In September Goodyear Tire & Rubber Company (US) unveiled a new line of products that incorporate advanced reclaimed rubber technology. This initiative reflects Goodyear's commitment to innovation and sustainability, as the new products are designed to meet the growing demand for eco-friendly solutions. The introduction of these products not only enhances Goodyear's market position but also signals a shift towards more sustainable manufacturing practices within the industry.

In August Continental AG (Germany) expanded its research and development facilities in Russia, focusing on the development of high-performance reclaimed rubber materials. This expansion is indicative of Continental's long-term commitment to the Russian market and its strategic intent to lead in innovation. By investing in local R&D, Continental aims to tailor its products to meet regional demands while enhancing its competitive edge.

As of November the competitive trends in the reclaimed rubber market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances among key players are shaping the landscape, fostering collaboration that enhances innovation and operational efficiency. The shift from price-based competition to a focus on technological advancement and supply chain reliability is becoming evident. Companies that prioritize these aspects are likely to differentiate themselves in a market that is evolving rapidly towards sustainability and efficiency.