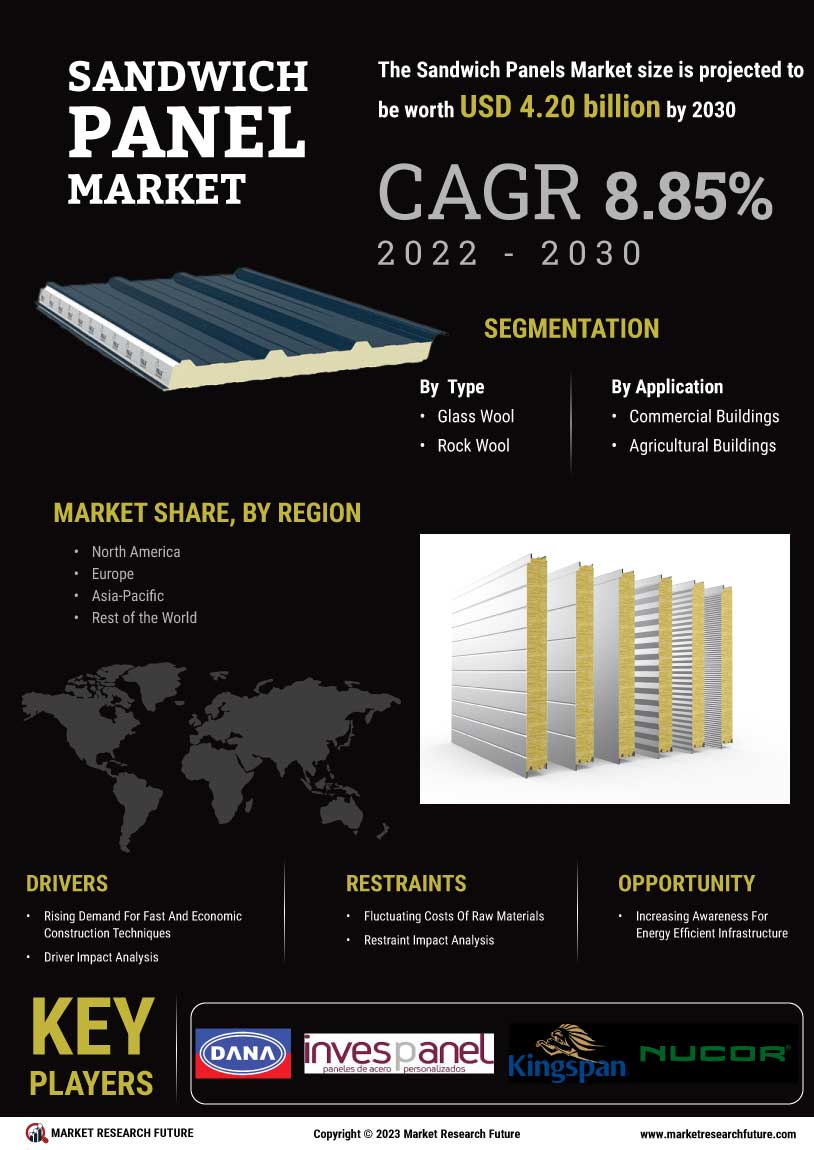

Market Growth Projections

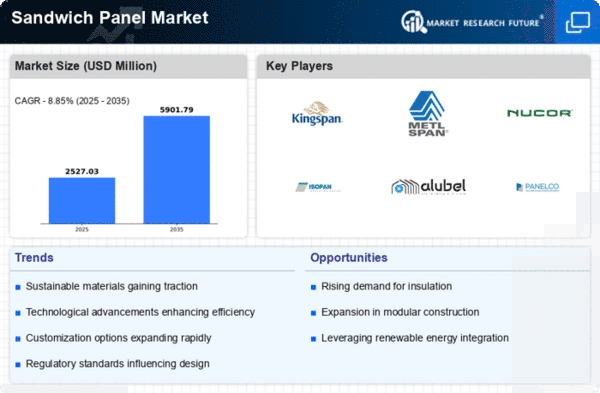

The Global Sandwich Panel Market Industry is projected to experience substantial growth over the next decade. With a market value anticipated to reach 5.9 USD Billion by 2035, this upward trajectory reflects the increasing adoption of sandwich panels in construction. The industry is expected to witness a compound annual growth rate of 8.86% from 2025 to 2035, driven by factors such as rising construction activities, technological advancements, and a focus on sustainability. These projections indicate a robust future for the sandwich panel market, highlighting its potential as a key player in the global construction materials sector.

Versatility in Applications

The versatility of sandwich panels across various applications is a key driver for the Global Sandwich Panel Market Industry. These panels are utilized in diverse sectors, including commercial, industrial, and residential construction. Their adaptability to different architectural designs and functional requirements makes them an attractive option for builders and architects. As the market evolves, the ability of sandwich panels to meet specific needs, such as fire resistance and sound insulation, enhances their appeal. This broad applicability is likely to sustain market growth, as more industries recognize the benefits of incorporating sandwich panels into their projects.

Growth in Construction Activities

The Global Sandwich Panel Market Industry is poised for growth due to the expansion of construction activities across various sectors. With urbanization and infrastructure development gaining momentum, the demand for lightweight and durable building materials is increasing. Sandwich panels, which offer quick installation and reduced labor costs, are becoming a preferred choice among builders. The market is expected to grow significantly, reaching 5.9 USD Billion by 2035, as more construction projects incorporate these panels to enhance structural integrity and reduce overall project timelines.

Rising Demand for Energy Efficiency

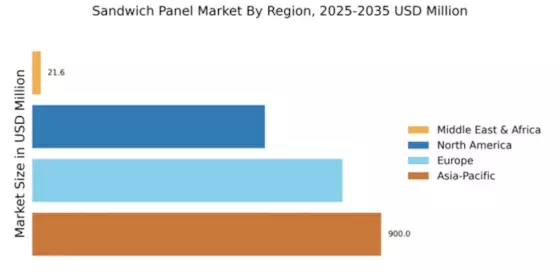

The Global Sandwich Panel Market Industry experiences a notable surge in demand driven by the increasing emphasis on energy efficiency in construction. Sandwich panels, known for their superior insulation properties, contribute significantly to reducing energy consumption in buildings. As governments worldwide implement stricter energy regulations, the adoption of these panels is likely to rise. The market is projected to reach 2.32 USD Billion in 2024, reflecting a growing preference for sustainable building materials. This trend is particularly evident in regions such as Europe and North America, where energy-efficient construction practices are becoming standard.

Environmental Sustainability Initiatives

The Global Sandwich Panel Market Industry is significantly influenced by the growing focus on environmental sustainability. As industries and governments prioritize eco-friendly practices, the demand for sustainable building materials, including sandwich panels, is expected to rise. These panels are often made from recyclable materials and contribute to lower carbon footprints in construction. This shift towards sustainability is likely to drive market growth, as stakeholders seek to comply with environmental regulations and meet consumer preferences for green building solutions. The increasing awareness of climate change impacts further propels this trend.

Technological Advancements in Manufacturing

Technological advancements in the manufacturing processes of sandwich panels are transforming the Global Sandwich Panel Market Industry. Innovations such as automated production lines and improved materials are enhancing the quality and performance of these panels. This evolution not only increases efficiency but also reduces production costs, making sandwich panels more accessible to a broader market. As a result, the industry is likely to witness a compound annual growth rate of 8.86% from 2025 to 2035, indicating a robust future driven by technological progress and increased adoption in various applications.