Top Industry Leaders in the Satellite Communication Market

Strategies Adopted: Key players in the SATCOM market deploy various strategies to maintain competitiveness and drive growth. These strategies include:

Fleet Expansion: Companies invest in satellite fleet expansion, satellite procurement, and satellite launch services to increase coverage, capacity, and geographic reach, enabling them to serve a broader customer base and meet growing demand for connectivity services.

Technology Innovation: Continuous investment in satellite technology innovation, including high-throughput satellites (HTS), software-defined payloads, phased array antennas, and ground segment advancements, allows companies to offer higher data rates, lower latency, and enhanced service capabilities to customers.

Vertical Integration: Vertical integration of satellite operators with ground segment providers, value-added resellers, and service providers enables companies to offer end-to-end SATCOM solutions, optimize service delivery, and capture additional value along the satellite communication value chain.

Strategic Partnerships: Collaborative partnerships with telecommunications companies, government agencies, defense contractors, and technology providers facilitate joint ventures, market access agreements, and co-development initiatives, enabling companies to expand market reach and address specific customer requirements.

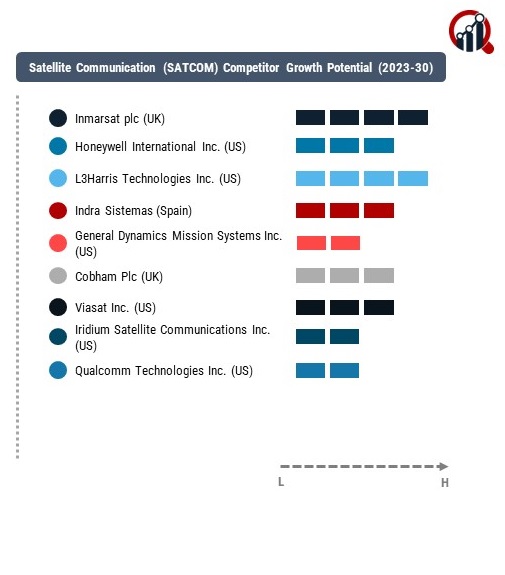

Key Companies in the satellite communication (SATCOM) market include

Inmarsat plc (UK)

Honeywell International Inc. (US)

L3Harris Technologies Inc. (US)

Indra Sistemas (Spain)

General Dynamics Mission Systems Inc. (US)

Cobham Plc (UK)

Viasat Inc. (US)

Iridium Satellite Communications Inc. (US)

Qualcomm Technologies Inc. (US)

Gilat Satellite Networks (Israel)

Factors for Market Share Analysis: Several factors influence market share in the SATCOM market, including:

Orbital Slot Allocation: Access to prime orbital slots and spectrum allocations for satellite deployment is critical for providing competitive coverage, minimizing interference, and maximizing service quality and capacity, giving companies with favorable orbital positions a strategic advantage.

Service Portfolio: Offering a diverse portfolio of satellite communication services, including broadband internet, voice, data, video, mobility, and enterprise solutions, enables companies to address a wide range of customer needs and capture market share across multiple market segments and verticals.

Customer Relationships: Building strong relationships with government customers, commercial clients, enterprise users, and channel partners through excellent customer service, reliable connectivity, and customized solutions fosters customer loyalty and retention, driving market share growth.

Regulatory Compliance: Compliance with international regulations, licensing requirements, spectrum management policies, and security standards is essential for gaining market access, securing government contracts, and maintaining regulatory approval for satellite operations and service provision.

New and Emerging Companies: In addition to established players, new and emerging companies are entering the SATCOM market, bringing disruptive technologies and business models. Some notable new entrants include:

SpaceX: SpaceX's Starlink constellation aims to provide global broadband internet coverage through a network of low Earth orbit (LEO) satellites, challenging traditional GEO satellite operators with lower latency, higher throughput, and lower-cost broadband services.

OneWeb: OneWeb is deploying a LEO satellite constellation to deliver high-speed internet connectivity to underserved and remote regions worldwide, leveraging advanced satellite technology and ground infrastructure to bridge the digital divide.

Amazon's Project Kuiper: Project Kuiper plans to deploy a constellation of LEO satellites to provide broadband internet access globally, targeting both residential and commercial customers with affordable and high-performance connectivity solutions.

Industry News and Current Investment Trends: Recent developments and investment trends in the SATCOM market reflect a growing demand for satellite communication services and emerging opportunities in the global connectivity market. Key highlights include:

5G Integration: Integration of satellite communication with 5G terrestrial networks to extend coverage, enhance capacity, and enable seamless connectivity in urban, rural, and maritime environments, driving collaboration between satellite operators and mobile network operators.

Government Contracts: Increasing government investments in satellite communication infrastructure, military SATCOM programs, and national broadband initiatives to support critical communications, disaster response, and national security requirements, stimulating demand for satellite services and equipment.

Digital Transformation: Acceleration of digital transformation initiatives across industries, including telemedicine, remote education, e-commerce, and IoT applications, fueling demand for satellite-based connectivity solutions to enable remote work, digital access, and data connectivity in remote and underserved areas.

Overall Competitive Scenario: The SATCOM market is characterized by intense competition, technological innovation, and strategic partnerships. Established players with extensive satellite fleets, global coverage, and diversified service offerings dominate the market, while new entrants and emerging companies challenge incumbents with disruptive business models, advanced technology solutions, and agile market approaches. As the demand for satellite communication services continues to grow, companies that invest in network expansion, service differentiation, regulatory compliance, and customer engagement will remain competitive in the dynamic and evolving SATCOM market landscape.

Satellite Communication (SATCOM) Industry Developments

In February, 2023

CobhamSatcom and RBC Signals, a global provider of satellite data transmission solutions, have extended their agreement to install CobhamSatcom's flexible Tracker 6000 and 3700 series ground stations globally. The two organizations' collaborative cooperation will significantly expand RBC Signals' enormous owned and partner ground network, allowing it to provide integrated communication services to NGSO missions and constellations for Earth Observation, IoT, and Space Situational Awareness.

In October 2022

Thuraya, Yahsat's mobility division, and eSATGlobal have struck a complementary commercial agreement to build a Next Generation IoT Platform. Apart from Yahsat's investment in eSAT, Thuraya and eSAT formed a business relationship that would provide Thuraya with secure, continuing access to an end-to-end LPWAN IoT system and portfolio. The system would be deployed over Thuraya's Mobile Satellite Services (MSS) GEO assets, providing clients with global access to an IoT portfolio.

In December 2022

Gilat Satellite Networks Ltd announced that the company and Intelsat are expanding their strategic partnership with multimillion-dollar agreements to strengthen in-flight connectivity (IFC) in the Americas. Gilat hubs already in place in the United States and Brazil will be updated to accommodate increased network capacity in order to fulfill expanding bandwidth demands on Intelsat's IFC network in the Western Hemisphere.