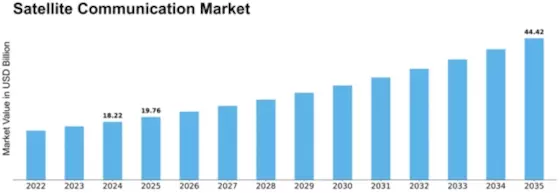

Satellite Communication Size

Satellite Communication Market Growth Projections and Opportunities

The satellite communication market is heavily influenced by several key factors that drive its growth and evolution. One significant factor is the increasing demand for high-speed, reliable, and ubiquitous connectivity across various industries and sectors worldwide. Satellite communication systems offer a unique advantage in providing global coverage and seamless connectivity, making them essential for applications such as telecommunication, broadcasting, internet access, maritime communication, and remote sensing. As the demand for data-intensive services and applications continues to grow, driven by trends such as digitalization, IoT (Internet of Things), and cloud computing, there is a corresponding increase in the demand for satellite communication services to support these applications and provide connectivity in areas where traditional terrestrial networks are unavailable or inadequate.

Moreover, technological advancements play a crucial role in shaping the satellite communication market. Advances in satellite technology, including high-throughput satellites (HTS), small satellites (smallsats), and software-defined payloads, have significantly improved the capacity, performance, and flexibility of satellite communication systems. HTS technology, for example, enables satellites to deliver higher data throughput and bandwidth efficiency, allowing for the provision of broadband internet services with speeds comparable to terrestrial networks. Smallsats, on the other hand, offer cost-effective solutions for satellite deployment and constellation development, enabling operators to expand coverage, increase capacity, and enhance service resilience. Additionally, software-defined payloads enable operators to reconfigure and optimize satellite resources dynamically, adapting to changing market demands and customer requirements.

Furthermore, market demand for satellite communication services is driven by factors such as globalization, connectivity gaps, disaster recovery, and mobility requirements. In today's interconnected world, businesses, governments, and consumers rely on satellite communication services to connect people, businesses, and communities across borders and continents. Satellite communication systems bridge connectivity gaps in remote and underserved areas, providing essential services such as telecommunication, internet access, and emergency communication where terrestrial infrastructure is lacking or inadequate. Additionally, satellite communication plays a critical role in disaster recovery and emergency response efforts, providing resilient and reliable communication links in the aftermath of natural disasters, humanitarian crises, and other emergencies. Furthermore, the increasing demand for mobility solutions, such as in-flight connectivity, maritime communication, and connected vehicles, drives market growth for satellite communication services that can provide seamless and uninterrupted connectivity on the move.

Moreover, regulatory frameworks and spectrum management policies significantly influence market dynamics in the satellite communication sector. Governments and regulatory authorities around the world are responsible for allocating and managing spectrum resources for satellite communication services, ensuring fair competition, and protecting the interests of stakeholders. Regulatory frameworks govern various aspects of satellite communication, including licensing, frequency allocation, orbital slot coordination, and spectrum usage rights. Additionally, international agreements and treaties, such as the Radio Regulations of the International Telecommunication Union (ITU), provide a framework for coordinating satellite communication services and resolving spectrum interference issues on a global scale. Compliance with regulatory requirements is essential for satellite operators and service providers to ensure legal compliance, operational integrity, and market access.

Furthermore, market factors such as industry consolidation, technological convergence, and competitive dynamics influence market trends and strategies in the satellite communication sector. The satellite communication industry is characterized by a diverse ecosystem of satellite operators, service providers, equipment manufacturers, and technology vendors. Industry consolidation and strategic partnerships are becoming increasingly common as companies seek to expand their market presence, leverage synergies, and capitalize on growth opportunities. Additionally, technological convergence between satellite communication and other sectors, such as aerospace, defense, telecommunications, and IoT, is driving innovation and collaboration in the development of integrated solutions and value-added services. Moreover, competitive dynamics in the satellite communication market are intensifying as new entrants, disruptive technologies, and evolving business models challenge traditional players and drive market disruption.

Moreover, the impact of emerging technologies, such as 5G, LEO (Low Earth Orbit) constellations, and high-throughput satellites, is reshaping the satellite communication market. 5G technology promises to revolutionize connectivity by offering ultra-fast speeds, low latency, and massive device connectivity, driving demand for satellite communication services that can complement terrestrial networks and extend coverage to underserved areas. LEO constellations, consisting of hundreds or thousands of small satellites in low Earth orbit, offer low-latency broadband internet services with global coverage, enabling new applications such as IoT, smart cities, and autonomous vehicles. Additionally, high-throughput satellites (HTS) leverage advanced technologies such as spot beams, frequency reuse, and onboard processing to deliver higher data throughput and bandwidth efficiency, meeting the growing demand for broadband internet services in rural and remote areas.

Leave a Comment