Market Analysis

In-depth Analysis of Saudi Arabia Agricultural Chemicals Market Industry Landscape

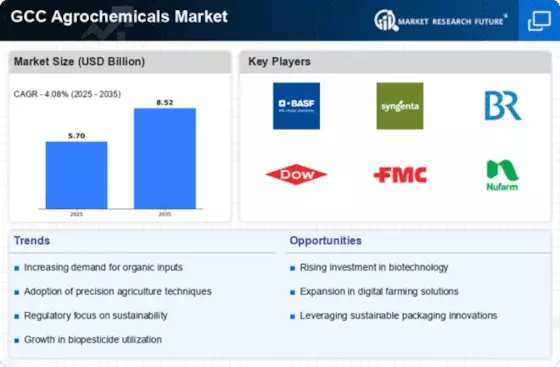

The impact of the dynamics of Saudi Arabia Agricultural Chemicals Market is more complex column gives an interesting view based on supply and demand in this sector of the society. In the past few years, the Kingdom of Saudi Arabia has undergone an agriculture regime transformation led by the necessity to attain food security and reducing dependence on foreign produce. This shift itself induced the demand of agricultural chemicals that became unstable and even drifted from time to time.

One of the main motives of a dynamism of the market in the kingdom of Saudi Arabia is the government's strategic reforms that seek to update and the diversification of the agricultural sector. The main goal of the Kingdom's Vision 2030 campaign is to ensure the dominance of the country in the production of some foodstuffs, which results in higher funds allocated to precision, efficient and advanced agricultural practices and technologies. Consequently, consumers' demands for chemical inputs (fertilizers and pesticides) has grown beyond measure to try and achieve maximum yields and avert losses to pests and diseases.

In addition, the climatic and geographical settings where its agricultural chemical markets thrive are among the reasons for its specificities. It may confront several difficulties like dry terrain and water shortage and, thus, requires intensive and innovative approaches in agrarian field. This is evidenced by the fact that precision farming technologies have attracted a big number of farmers who are operating to be environmental friendly in the production process of the formulation drugs. This has led to a situation where the market is inclined to sustainability practices.

Regulatory environment as well does renders as very important criterion which define market condition. History of control over agricultural components products marketing and distribution by the Saudi Food and Drug Authority (SFDA) in order to insure the quality and effectiveness of the products. Observation of these legal requirements a must for any market operator, otherwise the respective innovations will be affected; registration procedures will be delayed, as well as the access to market will not be easy at the beginning. The strict regulatory condition gives a competitive market, therefore only high-quality and rectidrulary products permissible can succeed.

On the one hand, domestic factors include ranchers, farmers, and wholesalers/supermarkets. International factors include commodity exchange markets, consumer demand, and shipping/transportation costs. The fact that international as well as domestic producers compete to exist in the market brings a gamut of products to the market. Such rivalry in commodity sectors brings the advancement into technology and operation thus ensuring customers access the better yields. Furthermore, there will always be entities of the world order, which prioritize the idea of organic and sustainable farming techniques, and this, in one way or another, may affect the decisions that Saudi farmers will make, impacting the demand for particular kinds of agricultural chemicals.

The at-first market dynamics will be shifted by the state of the art in agricultural research and development activities in the current time. The GMO use and the introduction of the biopesticides have added new objectives and obstacles to the Saudi Arabia agricultural chemicals market.

Leave a Comment