Top Industry Leaders in the Saudi Arabia Agricultural Chemicals Market

The Saudi Arabia agricultural chemicals market, valued at US$12.97 billion in 2023, exhibits a dynamic and competitive landscape driven by several factors like increasing agricultural activities, rising demand for crop protection products, government initiatives, and technological advancements.

Major Players and Strategies:

-

Global Giants: Leading multinational corporations like Bayer AG, BASF SE, Yara International, Syngenta Crop Protection AG, and Corteva AgriScience hold significant market share through established distribution networks, robust R&D efforts, and diverse product portfolios. They focus on innovation, sustainability, and strategic partnerships to maintain their dominance. For example, Bayer and BASF are actively investing in bio-based fertilizers and digital farming solutions.

-

Regional Competitors: Regional players like Saudi Delta Company Inc., The Arab Pesticides and Veterinary Drugs Mfg. Co. Ltd., and Gulf Fertilizers Company (GFC) cater to specific local needs and offer cost-effective alternatives. They leverage their understanding of the agricultural landscape and government regulations to build strong footholds. GFC, for instance, is expanding its production capacity of diammonium phosphate (DAP) to cater to the rising demand for fertilizers.

-

Emerging Players: Startups and local distributors are entering the market with niche offerings and specialized services. They capitalize on rising demand for precision agriculture technologies like drones and smart spraying systems. Saudi AgTech startup Naiz has developed an AI-powered platform for soil analysis and fertilizer recommendations, catering to the need for efficient resource management.

Factors Influencing Market Share:

-

Product Portfolio: Offering a comprehensive range of fertilizers, pesticides, and other agricultural chemicals catering to diverse crop types and regional needs is key to capturing market share. Companies like Yara International with its strong focus on specialty fertilizers are gaining traction.

-

Distribution Network: Establishing efficient and extensive distribution channels across the country ensures timely product delivery and market reach. Local players like The Arab Pesticides and Veterinary Drugs Mfg. Co. Ltd. leverage their established networks to their advantage.

-

Pricing Strategy: Balancing quality and affordability is crucial in a cost-sensitive market. Global players like Syngenta are opting for flexible pricing models, while regional players offer competitive pricing on locally produced chemicals.

-

Government Regulations: Navigating the complex regulatory landscape and complying with environmental and quality standards are essential for market success. Companies like Corteva actively engage with policymakers to advocate for favorable regulations.

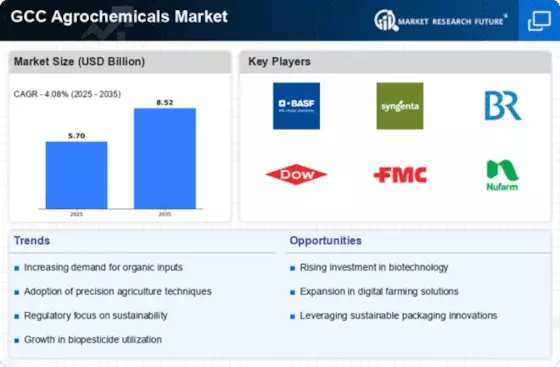

Key Companies in the agricultural chemicals market include

- Bayer AG (Germany)

- BASF SE (Germany)

- Yara (Norway)

- Compass Minerals (US)

- Syngenta Crop Protection AG (Switzerland)

- ADAMA (Israel)

- Sumitomo Chemicals Co. Ltd. (Japan)

- Nufarm (Australia)

- UPL (India)

- K+S Aktiengesellschaft (Germany)

- ICL (Israel)

- Rotam (South Korea)

- Corteva (US)

- FMC Corporation (US)

Recent News

-

September 2023: Saudi Delta Company announced plans to expand its fertilizer production capacity by 50%, indicating the growing demand for fertilizers in the region.

-

October 2023: The Saudi Ministry of Environment, Water and Agriculture approved new regulations for pesticide registration, emphasizing environmental safety and efficacy.

-

November 2023: BASF partnered with King Faisal University to launch a research program on climate-smart agriculture practices, highlighting the industry's commitment to innovative solutions.